In March 2020, for geopolitical reasons, Russia refused to go on with Saudi Arabia to adjust, along the rule of what is known as the OPEC+ deal, their oil extractions to world demand. It was normal, because there were alerting signs that oil demand might drop due to the coronavirus in China. Moscow refused Ryad’s request to adhere to the production cutbacks in order to support the price. Saudi Arabia, stung to the core, reacted in the opposite way and declared its intention to increase its crude production to more than 10 million barrels per day in April, once the OPEC+ deal will expire at the end of March. In addition, it has announced reducing the price by $6 to $8 a barrel for all its crude to all destinations. The consequence was not long in coming: the price of crude fell to around $32 a barrel. Oil futures suffered their biggest daily loss since 1991 during the Gulf War.

This geopolitical skirmish happens at the wrong moment. The Coronavirus epidemic was killing much more in Europe and USA than in China (officially!). Drastic measures taken everywhere to try to limit the pandemic had radical consequences on economy. In the face of the sharp drop in economic activity, demand for oil is in freefall. It is self-evident: airplanes that don't fly, cars that stay in the garage, deserted restaurants, closed cinema and stadiums, cancelled vacations cause the consumption of petroleum products to plummet. When disruptions occur in a huge market, speculators are quick to try to take advantage of the instability.

A negative price

When electricity from wind or solar sources is regularly “sold” at a negative price because nature produces when the market does not want it, nobody takes offense. Yet this unnatural price comes from the pocket of all consumers. We accept – or rather we do not talk about it – because it is “green” and therefore it is good. But it is enough that the oil is sold for a few minutes at a negative price for all the media, in particular social media, to go wild.

On April 20, WTI recorded a negative oil price; this completely abnormal event had never occurred before. This did not happen for Brent because it was actually a crisis caused by the price mechanism determined on the NYMEX and not because of the tension between oil supply and demand. Speculators thought that the collapse of prices for months would be followed by a rebound. To many small investors followed and the algorithm that determines the WTI price ended up yielding anomalous data. This technical epiphenomenon is hardly determining for the future of the oil market.

In addition, a storage problem occurred. As with any raw material, between production and consumption there are varying degrees of storage volumes. The economic collapse caused by the Covid-19 led to a huge, unexpected and almost instantaneous drop in demand for petroleum products. But production has not been stopped instantaneously. Once production activities, especially offshore, are suspended it takes months for them to restart and therefore attempts are made not to close immediately. Oil production has therefore continued for some time and did not decline as quickly as demand fell. It has been necessary to store this production. According to Kpler SAS, as of April 20, on a global scale onshore crude storage sits just below 3.5 billion barrels and floating storage is at 153 million barrels. According to Offshore Energy there are 27 oil tanker vessels with more than 20 million barrels of crude anchored off the coast of Southern California, waiting to offload their cargoes. So that oil stocks are saturated, tankers and supertankers still have some capacity, but storage prices have exploded. It is sometimes cheaper to sell at a loss than to pay for storage.

The price of WTI thus remains low ($11 at the time of writing), surprisingly low by the standards to which we have been accustomed since October 2014, when the price of a barrel of crude oil began its journey to peak at $147.02 on 11 July 2008. Inventories are so large that it will take months or even a year or two, depending on the strength of the recovery, to bring them back to the normal level of a fluid market.

The oil market is starting to work

Yes, the oil market is starting to work, and too bad if traders lose money! Too bad also for countries that can no longer play the geopolitical card. The Covid-19 crisis revealed to the general public and to some journalists who only had "the end of oil" in mind, that the main energy market (35% in the EU) is functioning and is no longer under the control of OPEC countries; nor of OPEC plus Russia (OPEC+).

No one can predict when the economic recovery will lead to consumption close to pre-crisis levels (close to 100 million barrels per day). As a result, abnormally low oil prices can be expected during the destocking period and well beyond. Of course, as soon as airplanes resume their normal course, trucks carry raw materials or finished products and car transport resumes, demand will allow oil companies to get out progressively of the rut.

A worrying phenomenon?

The very people who cannot stand the oil industry seems concerned about how bad things are going to get in that sector. Since 90% of the reserves are owned by states and the companies of most of those states, particularly in the Middle East, are not in a market economy, they have nothing to worry about: they will not go bankrupt. On the other hand, in the free world, there will be business failures among those who operate under transparent market rules. It is sad, but that is part of life in a market economy. This will lead to cheap takeovers by those who have had the means to resist during this crisis. At the end of the 1990s a wave of consolidations had already taken place, each time creating a group more powerful than the sum of its parts. Exxon bought Mobil for $82 billion to partially reform Rockefeller's Standard Oil. BP merged with Amoco. Belgium Petrofina merged with Total which resulted indeed in an absorption, with Total absorbing also thereafter the French company Elf.

This natural phenomenon is nothing to worry about. On the contrary, it creates economic efficiency (also energy efficiency!) which generates essential synergies to pursue the technological innovations that are the real engine of industry growth and which have finally led to the abandonment of the punitive geopolitics of certain oil-producing countries.

Of course, this will also happen in the shale oil business in the United States. But this is nothing new. I often like to recall that in December 2009, when during the COP-15 in Copenhagen the EU was trying to convince developing countries to follow it in order to reduce their CO2 emissions by 20% with the promise of € 7.7 billion in aid, ExxonMobil bought the unknown XTO Energy for $41 billion. The idea was to capture the deposits that the small company owned while the Majors had not realized the magnitude of the change - including geopolitical change - that shale oil would create. Other acquisitions, this time motivated by necessity, will take place. What's the matter with that?

What will happen tomorrow?

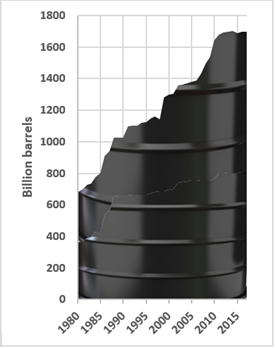

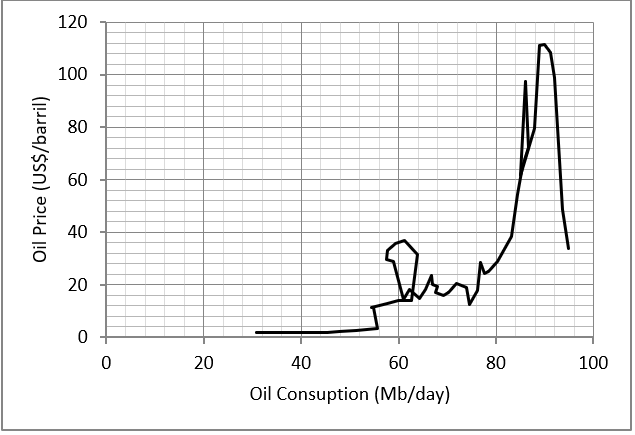

Oil is essential and will therefore continue to be black gold. Oil is not only essential; it is also abundant. If oil reserves were 357 billion barrels in 1965, 684 billion barrels in 1980, they are 1,730 billion barrels in 2018 (see Figure 1) and above all they are better diversified and distributed than during the oil shocks of the 1970s. All fears of the end of oil and its consequences - geopolitical sanctions - have been swept away by the technological innovations that have created this new reality that is determining for the geopolitics of the world. In this new oil paradigm, its price will therefore be finally determined primarily by demand because for the supply many oil producers have no others choice than selling oil if they want to have revenue. It will be the second time in the history; the first was at the beginning of oil production when the new product was expensive because the supply was scarce. After that we never had a clear correlation between oil demand and price (see Figure 2).

Of course, even in times of low prices, a small change in the price can generate huge gains or losses, so journalists will continue to enjoy reporting stories that should in fact be of interest only to traders and speculators. But this is not relevant to the oil sector, which does not care about journalists.

Figure 1 Oil reserves (BP 2018 data)

Figure 2 There was no correlation between oil price and consumption (data BP 2018)

The geopolitical consequences are already quite visible, with a very strong resizing of Iran and the near bankruptcy of Venezuela, a country that has the largest oil reserves in the world. Let us note that for the same reasons, the natural gas market is also becoming fluid and dynamic, so that the wholesale prices of gas and therefore also of the electricity produced by this gas will have a downward trend. As a result, the further development of intermittent renewable energies will require more and more subsidies. The Green Deal will therefore be more expensive than some people imagine.

The Coronavirus crisis has been a tragedy for thousands of families who have lost loved ones, for millions of unemployed people and for the global economy as a whole. However, it has highlighted the global paradigm shift: fossil fuels remain essential for our health care and our economy - in short, for our lives. They are not going to be abandoned quickly and the EU's Green Plan will not be as easy to implement as we are told.

Politically correct statements by Shell (or BP) that they will achieve carbon neutrality in 30 years' time (it remains to be seen whether these announcements mean zero oil) will in no way disrupt the huge and inevitable oil market, the non-EU countries will take care of it.

The petrochemical industry is currently in difficulty due to the closure or reduction in refinery activity caused by the decline in transport. Indeed, the raw material for petrochemicals is generated during the refining of oil into petroleum products, but it is of course the demand for transport fuel that determines production, since petrochemicals account for only 13% of oil demand. This situation could even lead to a shortage in the petrochemical chain if the crisis were to continue. But it will subsequently benefit from the new situation thanks to a sustainably low price for naphtha.

ICIS, a consultancy firm in the sector, estimates that out of the 12.1 million barrels distilled daily in Europe, 6.6 million barrels are random with a reduction of 2.2 million barrels already effective. As a result, naphtha is becoming scarcer, and its price is rising. ICIS estimates that 26 % of the ethylene market in Europe is at risk. The price of the raw material could increase. However, thereafter, when the price of oil and thus naphtha is permanently low, the production price of petrochemicals, and thus plastics, will remain low.

I would like to take this opportunity to make the reader aware of the importance of plastics. All the images of laboratories or hospitals that we are seeing right now show that without plastic, there would be none of this. And plastics are produced from oil.

To many policymakers can't see the forest for the trees. The revelation is not the low price of oil, but the paradigm shift we are experiencing. Oil - but also natural gas - is so abundant that we urgently need to change our key to reading the geopolitics of energy and its corollary, namely energy policy.

Samuele Furfari's latest work is a 1200-page, two-volume book "The changing world of energy and the geopolitical challenges". See furfari.wordpress.com