The coronavirus outbreak could go into history as the largest destructive event that has hit the global economy, global oil demand and prices since the Great depression of the 1930s.

2020 started with positive projections that the global economy is set to grow at 3.3% with global oil demand adding 1.2 million barrels a day (mbd) over 2019. But this was not to be. The outbreak changed everything.

The world has never ever faced such a more lethal and destructive cocktail of coronavirus outbreak, global recession, huge glut in the global oil market and an oil price war probably since the discovery of oil.

Already, economies around the world are shutting down. The International Monetary Fund (IMF) is projecting that the global gross domestic product (GDP) will shrink by 3% from a projected 3.3 % before the coronavirus outbreak and the resulting global lockdown to 0.3% this year. The IMF is, however, basing its projection on an assumption that the pandemic fades in the second half of this year and that containment measures can be gradually wound down.

A positive sign is that China is already bouncing back extremely quickly. This development will give a huge impetus to an oil market bereft of good news and may also prevent oil prices from sliding further downward.

The Impact on Oil Prices

If anything, the coronavirus outbreak with its destructive power of the global economy and the global oil market has proven irrevocably how inseparable oil and the global economy by demonstrating that destroying one automatically destroys the other and vice versa.

Estimates of the damage to the global oil demand vary but they overwhelmingly agree that the glut in the market has mushroomed to an estimated 1.8 billion barrels between globally stored oil and excess supply in the market and the global oil demand has declined by an estimated 30 mbd with oil prices crashing to mid-$20s (see Chart 1).

Chart 1

Source: Courtesy of Investing.com accessed on 18 April, 2020

With prices falling by more than 50% since hitting £60 a barrel in January, OPEC+ met on the 6th and the 7th of March to discuss new production cuts or deepening existing ones. Saudi Arabia called for deeper cuts amounting to 1.5 mbd at a time when Libya’s oil production had already lost 1.0 mbd.

Russia refused to agree deeper cuts arguing that OPEC’s proposal for cuts of between 600,000 barrels a day (b/d) and 1.5 mbd would have been ‘a drop in the ocean’ in a market where oil demand is plunging fast. Considering that oil demand was at the time plunging by 15 mbd and could reach 20 mbd in coming weeks, influencing the market with the cuts proposed by Saudi-led OPEC would have been impossible.

Russia’s refusal was the last straw for Saudi Arabia so it decided rashly to wage a price war against Russia and flood the global oil market with oil.

The rationale for Russia’s refusal is not without merit. Russian oil companies couldn’t switch off oil production at their oilfields as easy as US shale oil for instance. Moreover, any cuts will have no impact on oil prices without the United States doing its bit, which it will not. The US shale oil industry has been gaining more market share at the expense of OPEC+ producers.

Moreover, Russian oil companies have always been against any production cuts by OPEC+ arguing that they have invested heavily in expanding Russia’s oil production capacity and therefore they wanted a quick return on their investments. They also argued that OPEC+ cuts would have extended a lifeline to a sinking US shale oil industry.

Saudi Arabia Wields the Oil Price War Weapon

History is replete with Saudi Arabia repeatedly wielding the oil price war weapon unsuccessfully.

Early in the 1980s, Sheikh Ahmad Zaki Yamani, the veteran former oil minister of Saudi Arabia, suddenly awoke to Saudi Arabia’s need for market Share. He flooded the market with oil causing the oil price to collapse to $10/barrel. It later transpired that the Saudi need for a market share was just a cover for a CIA-Saudi conspiracy to expedite the downfall of the Soviet Union with the Reagan administration starting a costly arms race and Saudi Arabia depressing oil prices by flooding the market. Saudi Arabia ended bankrupting itself in the service of the United States.

In the aftermath of the 2014 crude oil price crash, the oil price lost 54% of its value and there were no indications that it will stop there in the absence of a major production cut by OPEC. At one point the price fell to $30.

Instead of agreeing production cuts with OPEC, Saudi Arabia ignored OPEC and flooded the global oil market with oil. Circumstantial evidence suggested some political collusion between Saudi Arabia and the United States behind the steep decline in oil prices aimed against Iran and Russia.

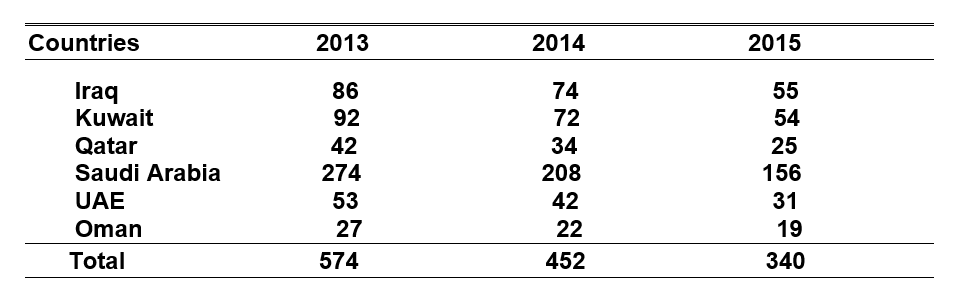

Saudi Arabia took advantage of the low oil prices to inflict damage on Iran’s economy and weaken its influence in the Middle East in its proxy war over Iran’s nuclear programme whilst the United States used the low oil prices to weaken Russia’s economy and tighten the sanctions against Russia over the Ukraine. Yet again, Saudi Arabia ended up losing $118 bn in oil revenue (see Table 1). It also sustained huge budget deficits of $140 bn in 2015 and $134 in 2016.

Table 1

Net Oil Export Revenues of the Arab Gulf Oil Producer

(US$ bn)

Source: U.S.Energy Information Administration's (EIA) 2014 Short-term Energy

Outlook (STEO) / Author's projections for earnings in 2014 & 2015

Saudi Oil Price War

Despite the bravado, Saudi Arabia could neither win a price war with Russia nor is able to flood the global oil market with oil for the following reasons.

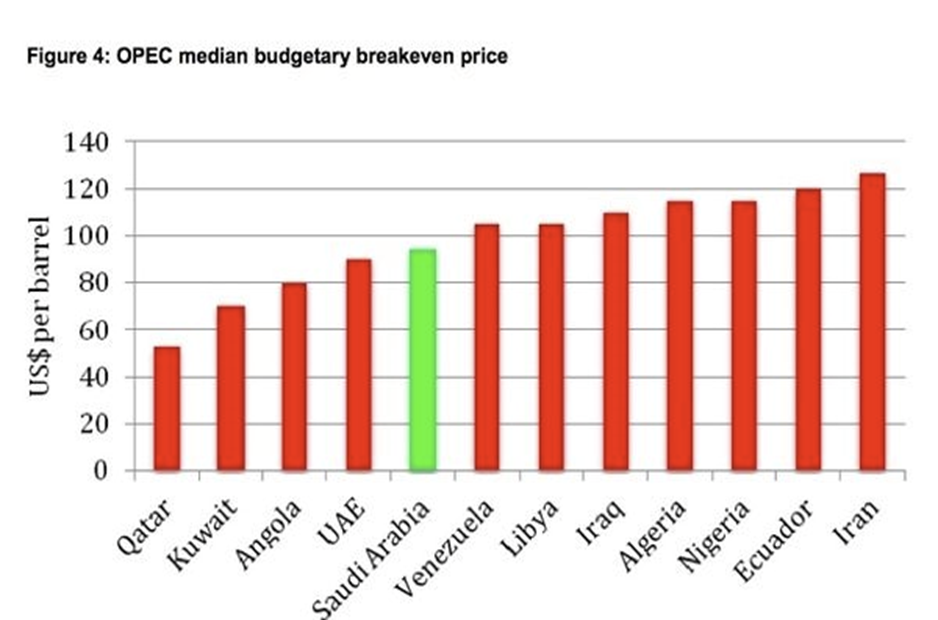

The first reason is that Russia’s economy can live with an oil price of $25 a barrel for years compared with $85-$91for Saudi Arabia’s (see Chart 2). Moreover, Russia’s economy is highly advanced and well diversified compared with Saudi Arabia’s overwhelmingly dependence on the oil revenues.

Chart 2

OPEC Median Budgetary Breakeven Price

Source: OPEC “Break-even” Prices (Courtesy of Matthew Hulbert/European Energy Review).

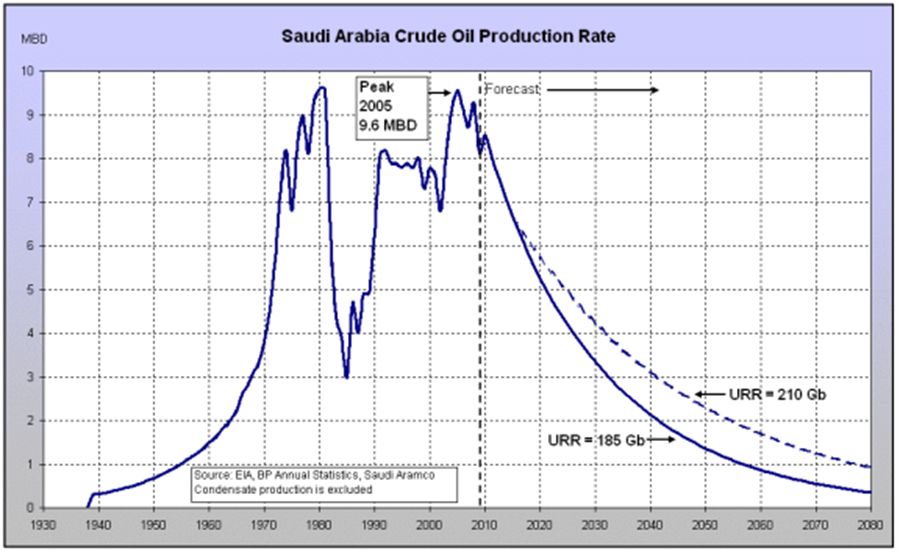

The second reason is that Saudi Arabia doesn’t have the production capacity to flood the global oil market with oil. Saudi Arabia has never ever had a production capacity of 12.5 mbd as it claims and will never ever achieve one. So the talk about raising its exports by 3.0 mbd is a farce. Its production peaked at 9.65 mbd in 2005 and has been in decline since (see Chart 3). Saudi Arabia can at best produce some 8.0-9.0 mbd with another 700,000 b/d to 1.0 mbd coming from storage. Current Saudi production comes from five giant but aging and fast-depleting oilfields discovered more than 70 years ago.

Chart 3

Saudi Oil Production Peak

Source: Courtesy of Saudi Aramco.

The third reason is that Russia’s lifting cost per barrel at $2.5 is lower than Saudi Arabia’s $2.8. This is due to the falling ruble against the dollar. Russian oil companies earn dollars and other hard currencies for their exports but pay for their operations in ruble. The lower the ruble slides against the US dollar, the lower the production costs of Russian oil companies.

Without the influx of billions of dollars of oil money, multi-billion projects that are deemed vital for Vision 2030 for the diversification of the Saudi economy will be delayed or even shelved indefinitely. Moreover, the economy will not be able to create more than 6 million jobs needed to employ Saudi Arabia's youth. The economy could crash on the back of an oil price war with a mushrooming budget deficit estimated at $116 bn.

To this could be added another loss of $200 bn being a 10% devaluation of Saudi Aramco’s shares raising the total to $316 bn. Moreover, the devaluation of Saudi Aramco shares is a major threat as Saudi citizens have been investing not only their own money but also borrowed money from banks to buy Aramco shares.

Saudi Aramco Chief Executive Amin Nasser claimed that his company is very comfortable with $30 oil. However, at $30 a barrel, Saudi Arabia could go bankrupt in less than two years.

Globally, the double supply-demand shock in the oil market could lead to companies deferring as much as $131 billion worth of oil and gas projects slated for approval in 2020.

It has become patently obvious that efforts by OPEC+ in the past to deplete the glut and arrest the slide of oil prices are being undermined by the US shale oil industry recklessly producing even at a loss and gaining market share at the expense of OPEC+ members.

The stability of Saudi Arabia depends on the Aramco domestic Initial Public Offering (IPO), Public Investment Fund projects and diversification. All can be linked directly and indirectly to OPEC+ and oil prices.

If Saudi Arabia persisted with its price war, it could have ended depleting both its sovereign wealth fund and its stored oil not bankrupting its economy and destabilizing the country.

The biggest loser in the current situation is the global economy and within the global economy the two largest losers could be Saudi Arabia and the US shale oil industry.

Impact on US Shale Oil Industry

Since its inception in 2008 the US shale oil industry has never been a profitable company. If it was judged by the strict commercial criteria by which other successful companies are judged, it would have been declared bankrupt years ago.

US shale drillers have been encouraged by easy liquidity provided by Wall Street and other investors to continue production even at a loss to pay some of their debts. In so doing, their outstanding debts have mushroomed to almost $1 trillion leading to large number of bankruptcies among them.

And with a breakeven price ranging from $48-$68 a barrel and a well depletion rate of 70%-90% after first year production, the overwhelming majority of shale drillers can’t survive low oil prices let alone a price war.

At $30-35 oil, US oil production could drop by around 1.5 mbd according to Russia’s oil ministry.

Still, President Trump’s administration is under pressure to keep the industry alive even if on a life support machine not only because it is a $7-trillion industry employing more than 2% of the work force and therefore very important for the US economy but also because it enables the United States to have a say in the global oil market along with Russia and Saudi Arabia.

President Trump is considering imposing a tariff on foreign crude oil exports to the United Sates to bail out the US shale oil industry at the expense of foreign oil producers. However, this measure is bound to fail since major crude oil exporters to may decide to shift their exports to the Asia-Pacific region rather than pay the tax.

Saudis Bowing to Trump’s Pressure to End Oil Price War

Saudi Arabia initially resisted pressure by the Trump administration to end the price war but eventually succumbed to President Trump’s pressure and called for an emergency meeting of OPEC+ for the 9th of April because it can no longer bear losses from the oil war. The fact that Saudi Arabia called for an urgent meeting of OPEC+ to discuss ways to stabilize the global oil market was an admission of the failure of the oil price war it waged against Russia. Saudi Arabia knew that it lost the war.

OPEC+ eventually agreed production cuts of 10 mbd with another 5 mbd coming from G20 producers such as Norway, Mexico, Brazil and Canada. President Trump refused to announce cuts saying that only free markets will determine US production cuts. Put plainly, he isn’t going to agree any cuts.

This raises a question about where were the free markets then when US shale oil producers were taking advantage of OPEC+’s cuts to enhance their market share at the expense of OPEC+ members by producing excessively even at a loss and undermining OPEC+ efforts to support oil prices by trying to cap them. Shale oil producers didn’t even spare a thought for other oil-producing nations of the world whose livelihood they have trampled on for years with the full knowledge that the Trump administration will bail them out even when their outstanding debts were heading towards $1 trillion. They continued to show the ugly face of capitalism. They paid for it by the recent collapse of the WTI crude oil price to less than $1 a barrel.

Will OPEC+-led Global Cuts Work?

The global oil market has already given its verdict on the OPEC+ production cut agreement. Oil prices dropped.

Production cuts no matter how big they are will hardly have a positive impact on oil prices whilst the coronavirus is still raging.

How could a 10 mbd or even a 20 mbd production cut impact positively on prices in a market sagging under the weight of a glut estimated at 1.8 billion barrels and declining by some accounts by 30 mbd with half the population of the world in a lockdown. While the cuts were massive, the destruction in oil demand is both larger and much more immediate.

“The global economy is under pressure in ways not seen since the Great Depression in the 1930s; businesses are failing and unemployment is surging,” the IEA wrote in its April Oil Market Report. “Even assuming that travel restrictions are eased in the second half of the year, we expect that global oil demand in 2020 will fall by 9.3 mbd versus 2019, erasing almost a decade of growth.”

Against this backdrop, the OPEC+ deal is unable to engineer an immediate rebound in prices. “There is no feasible agreement that could cut supply by enough to offset such near-term demand losses,” the IEA said.

Meanwhile, it is far better for countries of the world to implement the strict measures that enabled China to control the outbreak and open the country to business again. This will certainly shorten the duration of the global lockdown and enable people to resume their normal activities including demand for crude oil rather than wasting their time making cuts which are futile in the current circumstances.

China to the Rescue

China is already bouncing back extremely quickly with projections already abound that China could grow at 6.8% in 2021 compared with 6.1% in 2019. Given the speed by which China is bouncing back, it could be projected to grow at 4%-5% in the second half of this year compared with 3%-3.5% in the first half. Moreover, China will be hugely thirsty for crude oil. This development won’t only give a huge impetus to an oil market bereft of good news but may also prevent oil prices from sliding downward further.

The restarting of China coincides with the shutting down of most of the world’s economy causing lower commodity prices. Every crisis offers opportunities, including this one. China is seizing the opportunity of super-low oil and LNG prices to stock up on both.

Oil Markets in the Aftermath of the Coronavirus

Oil demand is expected to be down by nearly 30 mb/d in April and down by almost 10 mbd for the entire year according to the latest estimates. But some forecasts still optimistically assume that demand bounces back in the second half of the year.

Still, the IEA assumes that there is a resurgence in demand close to normal levels by the end of the year. But there are multiple reasons why the global economy may not return to anything close to “normal” even by the end of 2020.

Ultimately, economic activity may not rebound until a vaccine is readily available, or at least a robust system of testing that allows for a reopening of sections of the economy.

Despite the dire warnings, there is a growing optimism that once the outbreak is contained, the global economy and China’s in particular ill behave like a patient who has been quarantined with no food. Once out of the quarantine, his appetite would be rapacious and this is exactly how the global economy and the global oil market will react with oil imports doubling if not tripling to recoup lost demand. Oil prices and demand will recoup all their previous losses with prices event touching $50-$60 a barrel in the second half of this year.

Conclusions

If anything, the outbreak with its destructive power of both the global economy and the global oil market has proven irrevocably how inseparable the relation between oil and the global economy by demonstrating that destroying one automatically destroys the other and vice versa.

OPEC+-led global production cuts, no matter how big they are, will hardly have a positive impact on oil prices whilst the outbreak is raging.

And while the global oil demand will face a steep uphill struggle to recoup lost ground, it will start to recoup its losses from the second half of this year with help from a China bouncing back extremely quickly from its ordeal with oil prices even touching $50-$60 a barrel early next year.

-----------------------------------------------------------------------------------------------------------

*Dr Mamdouh G Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting Professor of Energy Economics at ESCP Europe Business School, London.