The race between electric vehicles (EVs) and internal combustion engines (ICEs) for market share and dominance will continue unabated throughout the 21st century and far beyond with huge implications for the environment, the global oil industry and the future of oil.

Three major trends support a rising demand for EVs. The first is that the future is electric. The second trend is the continued pressure to reduce carbon emissions and the third is that investors are beginning to think seriously about reducing their carbon footprint.

Still, I will argue that EVs are going to face an uphill battle against ICEs. And while they are bound to get a share of the global transport system, they will never prevail over ICEs. EVs’ share of the market could only decelerate slightly the demand for oil. As a result, ICEs will continue to be the dominant means of transport throughout the 21st century and far beyond.

The thrust of my arguments will be based on some pivotal factors including the global energy transition, EV logistics and the practicability and convenience of EVs.

The Global Energy Transition

Increased use of renewable energy, combined with intensified electrification, could prove decisive for the world to meet key climate goals by 2050. Ramping up electricity to over half of the global energy mix (up from one-fifth currently) in combination with renewables would reduce the use of fossil fuels, responsible for most greenhouse-gas emissions according to a study from the International Renewable Energy Agency (IRENA).1

Based on IRENA’s analysis, energy-related CO2 emissions would have to decline 70% by 2050 compared to current levels to meet climate goals. A large-scale shift to renewable-generated electricity could deliver 60% of those reductions; 75% if renewables for heating and transport are factored in; and 90% with ramped-up energy efficiency. 2

With electricity becoming the dominant energy carrier, global power supply could more than double, the report finds. Renewable sources including solar and wind, could meet 86% of power demand.

However, global energy transition will be governed by the following realities in the market and not by wishful thinking and realms of fantasy. The first reality is that there will be no post-oil era throughout the 21st century and probably far beyond. 3 It is very doubtful that an alternative as versatile and practicable as oil particularly in transport, could totally replace oil in the next 100 years and beyond. What will change is some aspects of the multi-uses of oil in electricity generation and water desalination which will eventually be mostly powered by solar energy.

The second reality is that there will be no peak oil demand either. Peak oil demand has become one of the most contentious and fascinating debates in the oil industry over the past few years with forecasts for the pending peak seemingly creeping closer to the present with every new publication. The precise dates vary from 2030s to 2040s. While an increasing number of EVs on the roads coupled with government environmental legislations could slightly decelerate the demand for oil, EVs could never replace oil in global transport.

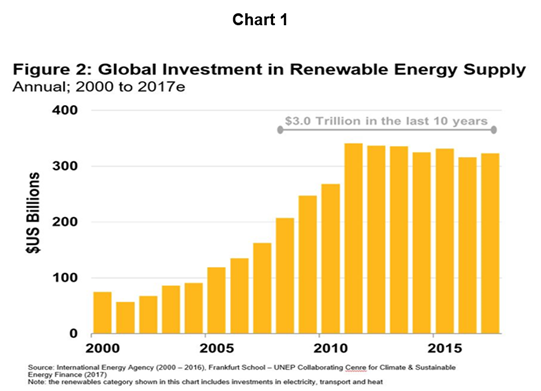

The third reality is that the notion of imminent global energy transition is a mirage. In fact, the percentage of fossil fuels in the world’s energy mix – coal, oil and gas – is still lingering well above 80%, a figure that has changed little in 30 years. 4 That remains the case despite being challenged by serious environmental policies and despite a global expenditure of $3 trillion on renewable energy during the last decade (see Chart 1).

The fourth reality is that oil and gas will continue to be the core business of the global oil industry well into the future. While the oil industry is investing huge amounts in renewables, such investment pales in size when compared with that in oil and gas. The slower pace of oil majors toward alternative energies is due to two key reasons. The first is that they all believe that oil and gas will continue to be needed well into the foreseeable future. And the second reason is that financial returns from renewables are nothing compared to those for oil and gas. 5

For now, we’re in an era of energy diversification where alternative sources to fossil fuels, notably renewables, are growing alongside—not at the expense of—the incumbents. Still, any mandatory transition to renewable energy and EVs will not achieve the desired outcome without individuals, businesses and governments getting on board about the benefits of transition.

However, for energy transition to accelerate, it should have three realistic objectives: benefit to users, practicability and lucrative financial returns from renewables to match those from oil and gas.

EV Logistics

Hardly a day goes by without another media report about the impending demise of the ICEs as they are replaced by super-clean EVs.

Some experts are now saying that widespread EV use could spell the end of oil. The tipping point, they reckon, is 50 million EVs on the roads. This they believe could be reached by 2024. 6 However, 50 million EVs could hardly make a dent on the global demand for oil let alone replace it.

Currently, EVs and hybrid cars combined number less than 5 million out of 1.5 bn ICEs on the roads worldwide, or a negligible 0.27%. The total number of ICEs is projected to reach 2.0 bn by 2025 rising to 2.79 bn by 2040 according to U.S. Research. 7

In 2019 the world consumed 36.9 bn barrels of oil (bb) of which 73% or 27.0 bb were used to power 1.5 billion ICEs. Bringing 50 million EVs on the roads will reduce the global oil demand by only 0.68 bb (equivalent to 1.87 mbd), or 2.5%. This will neither be the end of oil as some experts are suggesting nor a tipping point.

A tipping point for oil could only be reached once 750 million EVs (50% of the current global ICEs) are on the roads worldwide. This is impossible to achieve within that time frame. One then can only guess how many decades will have to pass before the entire global fleet of ICEs is replaced by EVs.

Moreover, growth in EV sales thus far has been supported by significant government subsidies. Sales would slump once the subsidies are withdrawn according to a report in April 2017 by U.S. Auto research firm Edmunds.

Furthermore, there will be a need for trillions of dollars of investment to expand the global electricity generation capacity in order to accommodate the extra electricity needed to recharge 50 million EVs. How could such expansion be sourced: nuclear, hydrocarbons or solar?

Practicability & Convenience

Despite the hype, EVs enjoy niche rather than mass-market appeal. Take-up of EVs among consumers remains relatively small. Three hurdles stand in the way of mass adoption of EVs: price, range and ease of charging.

The largest contributor to the price is the battery which could account for a significant portion of the cost of an EV. The dominant force in battery-powered cars is the costly lithium ion technology, the same used in laptops and mobile phones.

Other options are being pursued, from magnesium-based batteries to those that use silicon rather than carbon anodes. Solid state batteries, which promise much greater power and more flexible sizes, are also being investigated. Battery costs are a fraction of what they were ten years ago, but still have some way to go to be competitive.

Tesla for instance is said to be preparing to launch a million-mile battery as soon as this year or early in 2021 for its Model 3 in China as part of a wider plan to introduce longer-lasting, low-cost batteries that would bring EV prices to parity with ICEs. 8

The second and most significant public concern is range. EVs with a range of 250-300 miles remain positively expensive for many, costing between $70,000 and $100,000. Car manufacturers are pushing to hit a compromise on technology and price – a $35,000 car that can travel up to 300 miles.

The third and final hurdle is the ease and speed of charging at home and en route. Current technology allows batteries to deliver around 30 miles of range for every hour of charging. It would take the power output of 1,000 electric kettles to charge a car fully in two minutes – and rapid charging is damaging to most batteries. The nature of electricity doesn’t support the power transfers needed for two-minute charging, a long way into the future. It currently takes up to two hours to charge a car for a full range of 250 miles. 9

According to a recent AAA survey, 63% of Americans cited “not enough places to charge” as a reason not to purchase an EV. While many EV owners can charge their cars at home, they can’t yet recharge their vehicles with the ease and speed of gas stations. They need new fast-charging points. 10

There are more than 63,000 public charging stations in the US, a third of which are in California, but there is a need for hundreds of thousands more to enhance EV sales. Government support at all levels – federal, state, and local – is critical to spur investment in the charging and fuelling infrastructures needed for EVs.

Still, there is an accelerating momentum behind the shift towards EVs. The UK Government’s announcement to stop all sales of petrol and diesel cars by 2040 is the latest in a string of high-profile policy decisions in recent months. France has already announced its own ban on petrol and diesel vehicles by 2040.

These are seismic decisions, when one considers that at present there are only around 100,000 EVs in the UK out of a total car fleet of 31 million. 11

A major study by the National grid in the UK outlined many scenarios about the future progress of EVs. One scenario sees a dramatic rise in EVs with sales being more than 90% of all cars by 2050. Another features 25 million EVs on the UK roads by 2050. At the other end of the spectrum, other scenarios see low growth with EVs accounting for only 11% of car sales by 2050. The government’s announcement, if it becomes law, will clearly accelerate the move away from ICEs.12

The study concludes that as the numbers of EVs increase, their peak time electricity demand is one of the challenges that will need to be met. For example, EVs will create an extra 18GW of demand by 2050 – that’s equivalent to an extra 30% on top of today’s peak demand.

There is a lot of debate about different models for charging EVs in future. Several companies are investing in ‘flash battery’ technology that could allow a vehicle to run for a long distance from a five-minute charge. If successful, this super rapid EV charging could support the introduction of more forecourt charging sites.

Still, range, charging time and price are only temporary teething problems for EVs. Technology will sooner or later resolve them. However, the real challenge facing a deeper penetration of EVs into the global transport system is the realization that oil is irreplaceable now or ever.

And whilst EVs are benefiting from evolving technologies, ICEs are equally benefiting from the evolving motor technology. As a result, ICEs are not only getting more environmentally-friendly but they are also able to outperform EVs in range, price, reliability and efficiency.

Fad or Fixture: Are EVs the Future of Motoring?

EVs have been celebrated as the greener, cost-efficient future of travel. Still, at the back of many motorists’ minds, there’s a nagging question: Are EVs cheaper to maintain and run? 13

The initial cost of an EV tends to be higher than that of an ICE but the government in the UK for instance currently offers a grant of up to £3,500 towards brand new EVs. Moreover, EVs with a list price of under £40,000 are exempt from vehicle excise duty (road tax) as well as London’s congestion charge and its ultra-low emission zone (ULEZ) charge. EVs don’t need oil changes and have fewer moving parts, so one can save a bit on servicing and maintenance costs compared with a petrol or diesel car. 14

However, it is not the cost of oil changes and maintenance that matters most, it is ease of charging and also the availability of charging points particularly when one is embarking on a long journey of hundreds of miles. Furthermore, the running costs of EVs are not cheaper than ICEs given the continuous rise in electricity charges. It is claimed that charging an EV using a public charging point costs on average 8-10 pence a mile compared to 12-13 pence for a petrol or diesel car. But this doesn’t take into account the fact rises in electricity are far bigger than that of petrol or diesel.

A Robust Future for EVs Remains in Doubt

Projections about the spread of EVs have never been straightforward. A new study based on 17 forecasts submitted by governments, thinktanks, consultants, investment banks and oil industry representatives, helps to shed light on possible EV futures.

The study titled:” Electric Vehicle Penetration and Its Impact on Global Oil Demand Survey by Columbia University’s Centre for Global Energy Policy, puts a special focus on the link between EV spread and oil demand. But this comes with a warning that policymakers and shareholders overestimate how quickly the global oil demand trajectory can flatten and decline. 15

Despite positive trends in renewables and energy storage, projections for the spread of EVs have got less ambitious in 2019.This has to do mainly with expected increases in battery prices without subsidies, which could decrease the competitiveness of EVs with ICEs.16

EV batteries are expected to become competitive with ICEs only in 2025, which is when a $100/kWh milestone is reached. Uncertainty about growth rates has left its mark on overall EV sales with over 60% of surveyed entities having reduced their sales compared to last year’s survey. 17

It is claimed that policy actions to support de-carbonization and lower-emission transportation in the post-pandemic world could accelerate global energy transition and displace larger volumes of oil demand for road transport to the point of bringing peak oil demand closer than previously anticipated. 18

However, the CEOs of ExxonMobil and Shell the world’s two biggest supermajors poured cold water on such claims and made their positions on peak oil demand very clear. Darren Woods the chief executive of ExxonMobil demolished the environmental activists’ arguments when he declared that “the long-term fundamentals that drive our business have not changed.” This was echoed by Shell’s CEO Ben Van Beurden who said that it is entirely legitimate to invest in oil and gas because the world demands it”. “We have no choice.” 19

Conclusions

The global economy and oil and inseparable. There could neither be a global economy nor a modern civilization as we know and enjoy without oil. The global economy operates on oil and gas and will continue to do exactly that throughout the 21st century and probably far beyond.

EVs are going to face an uphill battle against ICEs. And while they are bound to get a share of the global transport system, they will never prevail over ICEs. EVs’ share of the market could only decelerate slightly the demand for oil by the global transport system. As a result, ICEs will continue to be the dominant means of transport throughout the 21st century and far beyond.

My conclusions are based on the arguments I presented and also on market realities and I am yet to find another convincing argument to persuade me otherwise.

---------------------------------------------------------------------------------------------------------------

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting professor of energy economics at the ESCP Business School in London.

Disclaimer: "The contents of this article are the author's sole responsibility. They do not necessarily represent the views of the Hellenic Association for Energy Economics or any of its Members".

Footnotes

1. Global Energy Transformation: A Road Map to 2050 (2019 edition), the International Renewable Energy Agency (IRENA), April 2019.

2. Ibid.

3. Mamdouh G Salameh, “A Post-oil Era Is a Myth” (A USAEE Working Paper Series No. 16-290 published on 8 December 2016).

4. Mamdouh G Salameh, “Oil, Natural Gas & LNG Will Keep Renewables Stranded Throughout the 21st Century”, IAEE Energy Forum / Fourth Quarter 2019.

5. Mamdouh G Salameh, “A Mandatory Energy Transformation Wouldn’t Work”, IAEE Energy Forum / Second Quarter 2020.

6. Mamdouh G Salameh, “A Post-oil Era Is a Myth”.

7. Green Car Reports, 7th of July 2014.

8. “The EV Boom Could Accelerate Peak Oil Demand”, posted by oilprice.com on May 21, 2020 and accessed on 22 May.

9. Mamdouh G Salameh, “A Post-oil Era Is a Myth."

10. Julia Rege, “The Future of Electric Vehicles”, posted on www.realclea energy.com on December 18, 2019 and accessed on May 22, 2020.

11. Case Studies accessed on 22 May 2020 from www.nationalgrid.com

12. Ibid.

13. Maria McCarthy, ”Fad or Fixture: Are Electric Cars the Future of Motoring? posted on www.theguardian.com on 20 May 2020 and accessed on 22 May.

14. Ibid.

15. Vitaliy Soloviv, “A Robust Future for EVs Remains in Doubt” posted on sustainability-times.com on December 26, 2019 and accessed on May 2020.

16. Ibid.

17. Ibid.

18. “The EV Boom Could Accelerate Peak Oil Demand”.

19. “Which Oil Major Is Best Prepared for the Future?" Posted by oil price.com on May 23, 2020 and accessed on 24 May. Fowler examines the road ahead.