Is the Global Oil Market Headed for a Supply Shock?

If anything, the COVID-19 pandemic with its destructive power of both the global economy and the global oil market has proven irrevocably how inseparable oil and the global economy are by demonstrating that destroying one automatically destroys the other and vice versa.

Furthermore, there could neither be a global economy nor a modern civilization as we know and enjoy without oil and gas and vice versa. The global economy operates on oil and gas and will continue to do so throughout the 21st century and probably far beyond.

At a time when the global economy is trying to disentangle itself from the destructive COVID-19 pandemic and the global economy trying to recoup an estimated 30% demand loss against a huge oil glut estimated to exceed 1.4 billion barrels, it may sound far-fetched indeed for anybody to be giving any thought to a potential oil supply shock in 2-3 years. And yet, this is exactly what market fundamentals are already telling us. The market could swing into a deficit sometime in 2022 causing oil prices to climb to $100 or more.

Many factors could contribute to this shock prominent among them the virtual collapse of the US shale oil production, China’s unquenchable thirst for oil and a huge decline in global investments in oil exploration and production.

The US Shale Oil Industry

Since its inception in 2008 the US shale oil industry has never been a profitable industry. If it was judged by the strict commercial criteria by which other successful companies are judged, it would have been declared bankrupt years ago.

US shale drillers have been encouraged by easy liquidity provided by Wall Street and other investors to continue production even at a loss to pay some of their debts. In so doing, their outstanding debts have mushroomed to hundreds of billions of dollars leading to large number of bankruptcies among them.

Few industries have been hit harder by the COVID-19 Pandemic than the US shale oil industry. While Brent crude oil price has taken quite a beating from an estimated 30% fall in global oil demand, a shortage of global oil storage and oil price war waged by Saudi Arabia against Russia, it has never sunk to negative. Not so with the West Texas Intermediate (WTI) crude benchmark which dipped to nearly $40 below zero a barrel in ‘Black April’.

The US Energy Information Administration (EIA) has now admitted that the US shale oil industry will be struggling to produce 7-8 million barrels a day (mbd) in July. The truth of the matter, however, is that shale oil will struggle to produce even 7 mbd during the next two years.

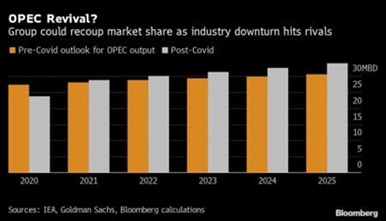

This severe downturn has many wondering what will become of the US shale industry once demand bounces back post-pandemic. This week Bloomberg suggested one possible outcome that may come as a shock to the sector. “Once the global oil market emerges from the pandemic, Bloomberg argued, “it may be greeted by a surprising change: greater dependence on crude from OPEC+.”

For the time being, OPEC+ is relinquishing part of its market share in the form of production cuts in a bid to prop up crude prices. But the current oil industry chaos could provide a unique opportunity for OPEC to emerge the clear winner in the coming years (see Chart 1).

Chart 1

Source: Courtesy of Bloomberg.

Can US shale stage a comeback? For as many energy-industry pundits who are predicting a US shale comeback, there are also just as many industry experts who are questioning whether or not we are seeing the inevitable demise of the shale industry.

I don’t think that the US shale oil industry will ever recover to pre-pandemic level for three major reasons. The first is that it has to pay back outstanding debts approaching $1 trillion. Investors won’t be rushing to invest in a bankrupt industry. Moreover, the current shutting-in of wells and the steep decline in shale production capacity could create a supply gap which will allow oil prices to soar to $100 in the not-so-distant future.

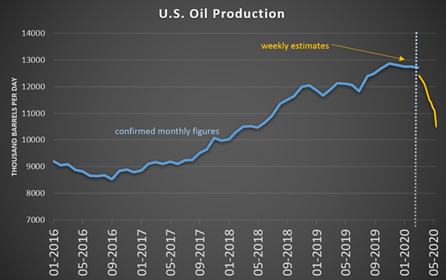

The second reason is the massive loss of rigs from 613 before the pandemic to 165 now. Rig count is a good way to predict future US oil production. Shale oil production reached 7.28 mbd in November 2019 or 60% of total US oil production of 12.23 mbd when the rig count was 613. Approximately 600 rigs are needed to maintain 7 mbd of shale oil. The rig count is now 165 so it is unavoidable that production will fall. Based on rig count analysis, US oil production could fall to under 7 mbd or more than 5 mbd less than peak November 2019 levels (see Chart 2).

Chart 2

Source: Courtesy of oilprice.com.

A third reason is that with a breakeven price ranging from $48-$68 a barrel and a well depletion rate of 70%-90% after first year production, the majority of shale oil drillers couldn’t survive prices under $70 a barrel. However, oil prices aren’t projected to hit $70 a barrel before 2022/23.

While lower US oil production will give a strong push to oil prices, it will be very bad for the US balance of payments as US crude oil imports could be projected to rise from 9 mnd in 2019 to 12-13 mbd in the next two years.

China’s Unquenchable Thirst for Oil

China accounts for 80% of global demand growth, 15% of demand and 16% of global crude oil imports. Its own demand and its imports are already back to 2019 levels. Furthermore, China is on the way to full economic recovery by the end of the year. This is the more impressive given that many analysts estimated that China’s crude oil demand lost 20% and its economy shrank by more than 6.0% in the first quarter of the year during the pandemic. China’s economy is projected by the International Monetary Fund (IMF) to grow at 6.8% in 2021 compared with 6.1% in 2019.

China is pulling the global economy out of its ordeal. My projection is that global oil demand will end the year at 98.34 mbd, a mere 3 mbd less than 2019 level of 101.34 mbd. By the end of 2021, global oil demand is projected to more than match 2019 levels.

And with rising demand from China, OPEC+ production cuts, and the accelerating easing of the global lockdown, the glut in the market will start to deplete fast.

Global Investments in Oil Exploration & Production

The pandemic has created the worst shock to economies since the Great Depression of 1930s and has decimated planned investments in all sectors including energy. The International Energy Agency (IEA) said that global energy investments are expected to drop by an “unparalleled” 20% this year.

The pandemic has also forced the global oil industry to defer as much as $131 billion worth of oil and gas projects slated for approval in 2020.

Moreover, the industry is set to see its total annual revenues plunge by a whopping $1 trillion this year from $2.47 trillion in 2019 to $1.47 trillion this year. The projection for 2021 is $1.79 trillion.

The oil industry needs to spend heavily just to maintain production - something that is clearly not happening with global upstream investments expected to fall to a 15-year low of $383 billion in the current year.

As a result there could be a supply shortage of 15-20 mbd in the next 2-3 years sending oil prices rocketing above $100. This couldn’t be a bad prospect as it will invigorate the global economy by attracting global investment into the oil industry and enabling both the oil industry and the oil producers to invest in exploration and production of new oil.

The global oil industry has no alternative but to cut dividends drastically and dispose of any non-core business in order to survive rather than sink under the weight of its outstanding debts.

The industry says it needs the cash resources saved from the dividends’ cut to shift to a position of net zero carbon emissions by 2050. But the industry knows that zero emissions by 2050 and an imminent global energy transition from oil and gas to renewables are illusions. There was no ambiguity whatsoever when the CEOs of ExxonMobil and Shell the world’s two biggest supermajors recently made their positions on peak oil demand very clear. Darren Woods the chief executive of ExxonMobil declared that “the long-term fundamentals that drive our business have not changed." This was echoed by Shell’s CEO Ben Van Beurden who said that it is entirely legitimate to invest in oil and gas because the world demands it". "We have no choice."

Oil will continue to be the fulcrum of the global economy and the core business of the global oil industry well into the future. As a result, oil prices will have to reflect this probability.

*Dr Mamdouh G Salameh is an international oil economist. He is a leading expert on oil. He is also a visiting professor of energy economics at ESCP Europe Business School in London.