Introduction

Deng Xiaoping was the inspirational architect of contemporary China and is thus among the towering figures of the twentieth century.

Deng’s mantras to China’s future leaders were that China should “observe developments soberly, maintain our position, meet challenges calmly, hide our capabilities and bide our time, remain free of ambition, never claim leadership. China should not attempt to be a hegemon, it should never practice power politics and it should never pose a threat to its neighbours or to world peace”. These are mantras that Chinese officials continue to repeat.

Three quintessential objectives occupy China’s strategic thinking. The first is securing its oil and energy needs peacefully. The second is ensuring its energy security and the third objective is dethroning the petrodollar and replacing it with the petro-yuan as the global oil currency. All three objectives are directly connected with oil and energy.

China’s economy is the world’s largest estimated in 2019 at $27.5 trillion based on purchasing power parity (PPP) used by both the World Bank and the International Monetary Fund (IMF) to assess GDPs of the world compared with $21.5 trillion for the United States.

China currently accounts for 24% of global primary energy consumption, 14% of crude oil consumption, 15% of crude oil imports, 6% of global refining capacity and 80% of oil demand growth but only 4% of production.

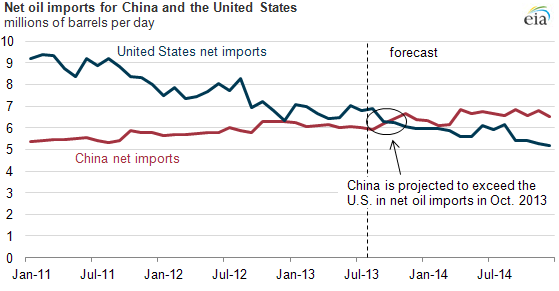

In October 2013, China overtook the United States to become the world’s largest importer of crude oil (see Chart 1).

Chart 1

Net Oil Imports for China & the United States

(mbd)

Source: Courtesy of EIA Short-term Outlook, August 2013.

Securing China’s Energy Needs

Since it became a net oil importer in 1993, China has greatly increased its oil imports from 20,000 barrels a day (b/d) then to an average of 10.72 million barrels a day (mbd) in 2019 accounting for 75% of its consumption and this is projected to rise to 87% by 2030 (see Table 1).

Table 1

China’s Crude Oil Production, Consumption & Imports

(mbd)

------------------------------------------------------------------------------------------------

2014 2015 2016 2017 2018 2019 2025 2030

Production 4.21 4.29 3.98 3.82 3.78 3.69 3.25 3.00

Demand 11.23 11.99 12.30 12.84 13.53 14.23 18.25 23.85

Net Imports 7.02 7.70 8.32 9.02 9.75 10.72 15.00 20.85

Imports as %

of demand 63 64 68 70 72 75 82 87

----------------------------------------------------------------------------------------------------------------

Sources: BP Statistical Review of World Energy, June 2019 / 2019 OPEC Annual World Oil Statistical Bulletin 2012 / Oilprice.com / Authors estimates

According to Bloomberg News on the 18th of May 2020, China’s oil demand has already rebounded to nearly pre-pandemic levels.

China was the first to go into lockdown after the coronavirus outbreak but it was also the first country to exit it.

In February and early March during the full lockdown and extended factory shutdowns, China’s oil demand was reported to have plunged by around 20%.

However, over the past few weeks more and more encouraging signs have emerged that China’s oil demand is recovering and helping lift global oil demand from the lows of the ‘Black April.’

Despite the outbreak, China’s crude oil imports in the first four months of 2020 averaged 10.11 mbd and were slightly higher than the same period of 2019. Moreover, China has been taking advantage of super-low oil prices to expand its strategic oil reserves before prices rise again. It is also stocking up on cheap LNG.

In 2019, China’s primary energy consumption amounted to 3414 million tonnes of oil equivalent (mtoe) the world’s largest of which oil accounted for 675 (20%), gas 287 (8%), coal 1907 (56%), nuclear 79 (2%), hydro 281 (8%) and renewables 185 (6%).

China’s pursuit for renewable energy is motivated by the urgent need to tackle environmental pollution and the security of its energy needs.

China is also making advances in electric vehicles (EVs) for the same reason of tackling environmental pollution. But there China, like the whole world, faces logistical issues including the huge investments needed to expand the electricity generation to charge the millions of EVs to come on the roads and the sourcing of the expansion: will it be sourced from natural gas, coal, nuclear energy and renewables or from a combination of all.

Still, EVs are going to face an uphill battle against internal combustion engines (ICEs). And while they are bound to get a share of the global transport system, EVs will never prevail over ICEs. EVs’ share of the market could only decelerate slightly the demand for oil. As a result, ICEs will continue to be the dominant means of transport throughout the 21st century and far beyond.

Chinese Energy Security: a Serious Concern

The growing dependence on oil imports has created an increasing sense of ‘energy insecurity’ among Chinese leaders. Some Chinese analysts even refer to the possibility that the US is practicing an ‘energy containment’ policy toward China, or could implement one in the future. Chinese leaders tend to believe that dependence on imported oil leads to great ‘strategic vulnerability’.

US naval presence at the southern end of the Strait of Malacca between Malaysia and Indonesia, through which 80% of China’s imported oil moves, is regarded with particular suspicion. The channel is 625 miles long, and less than two miles wide at its narrowest point (see Map 1). The Strait is the second most important chokepoint in the world in terms of oil volumes after the Strait of Hormuz with 16 million barrels of oil crossing it daily.

And with India guarding the northern end of the strait, China feels sandwiched in and strategically vulnerable. The former President of China, Hu Jintao, has referred a number of times to what he describes as the ‘Malacca dilemma’. ‘Certain powers, ‘he has declared, ‘have all along encroached on and tried to control the navigation through the Strait’. There is no mistaking whom he means.

Map 1

The Strait of Malacca

The Chinese government views the country’s dependence on imported oil as a chink in its armour that must be defended, in particular against an increasingly unilateralist US that has not shied away from using its military muscle to defend its oil interests.

China has sought to do so through two initiatives. One is its ‘Strings of Pearls’ (SOP) policy which aims to defend the shipping lanes that are vital to its oil lifeline, namely the Straits of Hormuz and Malacca. The government appears particularly aware of the US naval presence in the Strait of Malacca and its ability to blockade it in the event of conflict over Taiwan or with Japan over the oil and gas riches of the South China Sea.

The other initiative is to reduce its oil import dependence on the Middle East and secure most of its oil and gas needs overland by pipeline primarily from Russia. And although China does source a lot of its energy needs from Russia for economic, Strategic and security reasons, Russia can’t on its own provide all the energy needs of China and that is why China’s dependence on Arab Gulf oil imports will continue well into the foreseeable future.

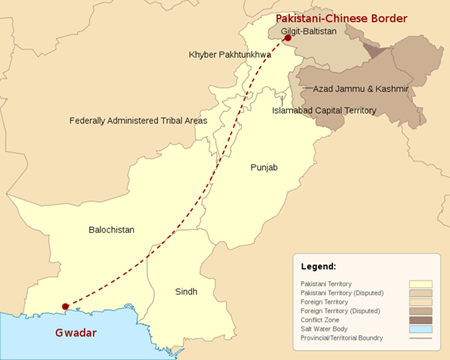

The first and westernmost pearl in the string is the deepwater port of Gwadar in Pakistan, which cost $248 million to develop and was 80% financed by China (see Map 2).

Map 2

The Proposed Gwadar-Western China Oil Pipeline

The port is of immense strategic location and importance being just 250 miles from the Strait of Hormuz. It provides China with a listening post for monitoring shipping traffic to and from the oil-rich Middle East also a trade route to the Central Asian republics. The port at Gwadar could also monitor US naval activity in the Gulf, Indian naval activity in the Arabian Sea and future US-Indian maritime cooperation in the Indian Ocean.

China is overwhelmingly dependent on the Strait of Malacca and this vulnerability has led to several Chinese initiatives to find alternatives. The Strait links the Indian and Pacific Oceans, and is the main route for oil from the Middle East to reach Asian markets.

China’s answer to the “Malacca Dilemma” was the newly-opened China-Myanmar crude oil pipeline (see Map 3).

The 479-mile-long oil pipeline runs from the port of Kyaukpyu on Myanmar’s west coast and enters China at Ruili in Yunnan Province

The pipeline loads oil shipments from the Bay of Bengal, and ships it to China’s Yunnan province. The pipeline has a capacity of 442,000 b/d. There is also a natural gas pipeline that runs along the same route, with a capacity of 424 billion cubic feet per year.

Map 3

The China-Myanmar Crude Oil Pipeline

China has also been considering a multi-billion-dollar pipeline that would carry crude oil from Pakistan’s coastal port of Gwadar to Western China.

That initiative has not yet broken ground, although Gwadar figures into a much broader strategic plan for China, beyond oil shipments.

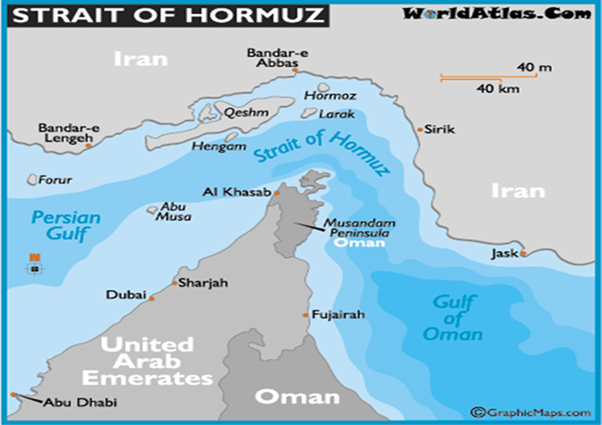

Similarly, the US military presence in the vicinity of the Strait of Hormuz through which over half of China’s oil imports come – is viewed with increasing concern. By establishing commercial or military ties in the strategic ports stretching from the Arab Gulf to the East China Sea, China hopes to have a secure and uninterrupted flow of oil.

Through this most vital chokepoint in the world, 20 mbd of oil traffic, almost a third of the global oil trade and a third of global LNG supplies, pass every day. At its narrowest point, the Strait of Hormuz is only 21 miles wide (see Map 4).

The U.S. Navy patrols the area because of its strategic importance. Iran has threatened to disrupt oil traffic through the Strait if its crude oil imports were prevented from passing through the Strait.

Map 4

The Strait of Hormuz

Dethroning the Petrodollar

The 26th of March 2018 will go in history as the most momentous day for the United States’ economy, China’s economy and the petrodollar and also for China’s status as an economic superpower. In that day China launched its yuan-denominated crude oil futures in Shanghai thus challenging the petrodollar for dominance in the global oil market.

The Petrodollar is the money that oil-exporting nations receive from selling their oil in US dollar-denominated currency. The term was first coined by Egyptian-born American economist, Professor Ibrahim M Oweiss of Georgetown University in a pioneering work on petrodollar surpluses in 1974.

The petrodollar came into existence in 1973 in the wake of the collapse of the international gold standard which was created in the aftermath of World War II under the Bretton Woods agreements. These agreements also established the US dollar as the reserve currency of the world. Former US president Richard Nixon and his then foreign secretary Henry Kissinger understood that the collapse of the gold standard system would cause a decline in the global demand for the US dollar.

Maintaining that “artificial dollar demand” was vital for the United States’ economy. So the United States under Nixon struck a deal in 1973 with Saudi Arabia under which every barrel of oil purchased from the Saudis would be denominated in US dollars only. Under the terms of the deal, the Saudis would agree to price all of their oil exports in US dollars exclusively and be open to investing their surplus oil proceeds in US debt securities. In exchange, the United States offered weapons and protection of Saudi oilfields. In 1975, all of the OPEC nations agreed to follow suit.

The petrodollar system provides at least three immediate benefits to the United States. It increases global demand for US dollars. It also increases global demand for US debt securities and it gives the United States the ability to buy oil with a currency it can print at Will. In geopolitical terms, the petrodollar lends vast economic and political power to the United States. China hopes to replicate this dynamic. Maintaining the petrodollar is America’s primary goal. Everything else is secondary.

China has been planning for years to dethrone the US dollar. The truth of the matter is that China does not plan to allow the US financial system to dominate the world indefinitely.

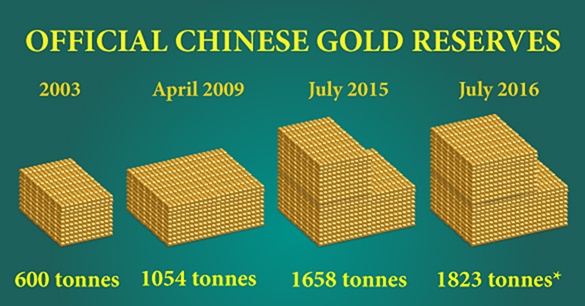

The Chinese would like to see global currency usage reflecting the shift in its global economic power. At the moment, most global trade is conducted in US dollars and more than 60% of all global foreign exchange reserves are held in US dollars. China has begun to publicly worry about the level of US debt. Chinese officials have publicly threatened to stop buying any more US Treasury Bills. Furthermore, China has been accumulating unprecedented amounts of gold in support of its crude oil futures contract (see Chart 2). All of these moves are setting up the moment in the future when China will completely pull the rug out from under the US dollar.

Chart 2

Chinese Official Gold Reserves, 2003-2016

Source: Chinese Gold Market Infographic, Bullion Star.

With major oil exporters finally having a viable way to circumvent the petrodollar system, the US economy could soon encounter severely troubled waters. Hitherto, the US dollar has had the monopoly over oil contracts as it enjoyed the status of the only currency in which major oil contracts could be made. This meant that US could get away by having outstanding debts estimated at $23 trillion and rising as it could print dollars backed by “black gold”. With the petro-yuan a reality now, China will, in effect, be making a claim to global oil reserves.

The imposition of tariffs on Chinese goods at the time of the launching of the petro-yuan in 2018 could have been the first shots in the petro-yuan/petrodollar war of attrition. A trade war ensued with the United States and China imposing tariffs against each other’s exports.

A resumption of the Trade War

The intensifying anti-China rhetoric means that President Trump is preparing to break the terms of the so-called Phase 1 trade deal between the two countries reached in December 2019 and resume the trade war immediately after the US exits the lockdown. He will not fare better than the previous time.

If, however, President Trump resumes the trade war, he will find that China has very powerful weapons in its arsenal.

The first is for China to offload its holdings of US Treasury bills estimated at $1.3 trillion. That will immediately cause a steep devaluation of the dollar.

The second weapon is for China to impose an embargo on the supply of rare earth minerals to the United States. That could potentially cripple large swathes of US industry from smartphones, turbines, lasers, missiles, advanced weapon sensors, stealth technology and jamming technology to name but a few.

A third weapon is to use the petro-yuan to undermine the petrodollar as the world oil currency. By undermining the petrodollar, China would be also undermining the US financial system and also the US economy.

Implications of China’s Oil Strategy for Other Major Players

In pursuit of its diversification of its oil and energy needs and its geopolitical interests, China’s oil strategy impacts on other major oil players.

Iraq

The US war on Iraq in 2003 was undoubtedly about oil. The prize was Iraq’s spectacular oil wealth estimated at 330 billion barrels (bb) of proven and semi-proven oil reserves.

And while the United States won the military battles in Iraq, it lost the war. The winners were China and Iran. China is now the biggest investor in Iraq’s oil industry and the second largest importer of Iraqi crude oil. In 2009 the Iraqi government awarded the contract to develop the giant Rumaila oilfield with 17 bb of proven reserves to CNPC of China and BP. China is also involved in the development of the giant Majnoon oilfield with proven reserves of 11 bb.

Iran emerged with the most political influence in Iraq. In its conflict with the United States over the sanctions, it is now marshalling support inside Iraq to eject US forces from the country.

Iran

China is now Iran’s number one oil importer importing an estimated 659,000 b/d or 31% of Iran’s crude oil exports in defiance of US sanctions.

China has been providing a huge political and economic support to Iran particularly while it is facing intrusive US sanctions. It will soon be given the contract to develop the huge Iranian oil field the Yadavaran from which it will get 150,000 b/d for 25 years.

The China connection has been a vital strategic and economic lifeline for Iran. Not only is China defying US sanctions against Iran, but it is also paying for Iranian crude oil imports in petro-yuan thus bypassing the US dollar and also having the ability to buy the entire Iranian oil exports of 2.125 mbd thus nullifying the whole US sanctions regime.

Venezuela

China’s and Russia’s loans-for-oil have kept Venezuela’s economy and its oil industry ticking long before US sanctions were imposed and certainly after.

China continues to buy Venezuelan crude oil in defiance of US sanctions and is also helping Venezuela increase production of both oil and refined products. Venezuela pays China in oil shipments.

Russia’s oil giant Rosneft has until very recently been helping Venezuela market at least 70% of its crude around the world particularly to India. When Rosneft finally announced its departure from Venezuela a few weeks ago, American officials were quick to claim a win for the sanctions campaign. But their victory was premature.

While sanctions decoupled Rosneft from Venezuela, the departure of the oil company didn’t signal Russian abandonment of Venezuelan President Maduro. It is only a desire to avoid further sanctions at a time of economic downturn. Instead, the divestment of Rosneft was to sell off its Venezuelan assets to none other than an entity owned by the Russian government.

Saudi Arabia

Saudi Arabia supplies some 1.6 mbd or 15% of China’s oil imports and is an object of assiduous Chinese courtship – again, a direct challenge to the United States’ traditional sphere of influence. China has offered Saudi Arabia preferential partnership rights to build oil refineries in China that can refine heavier Arabian crude.

For the moment Saudi Arabia knows that its long-term security and its defence interests lie with the United States but it might one day make sense for the Saudis to align themselves with a rising superpower like China. This reality has already begun to mean that China has diplomatic opportunities to confront the United States which were not available even five years ago.

Saudi oil strategy is to enhance its market share in both China and the EU. However, Russia has been gaining market share at the expense of Saudi Arabia first because China has vested strategic interests with Russia and second because Russian piped oil exports to China are cheaper than Saudi shipped oil exports particularly at a time of rising shipping rates. Russia retains the same advantage in the EU for its oil and gas exports.

Russia

Russia is of great interest to China not only because it is a major supplier of crude oil, gas and LNG to it but also because it is a quintessential partner under the China-Russia strategic alliance.

Russia owns and runs oil and gas pipelines to China providing vast quantities of crude oil, natural gas as well as LNG. This helps China overcome issues of energy security related to crude oil shipments from the Gulf having to pass through the very critical chokepoints of the Straits of Hormuz and Malacca.

Furthermore, Russia is the largest recipient of Chinese investments under the BRI particularly the Russian gas company Novatek LNG plants at Yamal in the Russian Arctic.

The United States

Before President Trump started a trade war with China, the Chinese market was a natural and promising outlet for US LNG exports and some 300,000 b/d of extra light oil.

The trade war changed everything. US energy exports to China paid a heavy price when China retaliated against the US by imposing heavy tariffs on these exports.

In any resumption of the trade war by President Trump, China will do its utmost to undermine the petrodollar which has been the core of the US financial system and therefore the economy since 1973. However, it is also the Achilles heel of the United States. Undermine the petrodollar and you undermine the whole US financial system and the US economy.

Why the Future of Oil Rests on China?

The future of oil does rest on China. The pace of global oil demand recovery could be shaped by China’s thirst for oil and the size of the economic stimulus that the Chinese government will decide upon to chart the course for the Chinese economy in the aftermath of the coronavirus pandemic.

The stimulus will be geared towards supporting infrastructure and railroads and other commodity-intensive sectors which are bound to drive up China’s demand for crude oil, fuels, and other commodities, including steel and copper. Spending on technology, transportation, and power infrastructure could reach $205 billion in 2020. China’s economy is projected to grow at 6.8% in 2021 compared with 6.1% in 2019.

Is It Time for a New World Order?

More than two centuries ago, Napoleon Bonaparte uttered a wise dictum that “China is a sleeping giant. Let her sleep, for when she wakes she will move the world’. Now this giant is hell-bent on dethroning the indispensable superpower and establish a new world order.

The COVID-19 Pandemic may have sharpened the race for a new world order. The bashing of China in the United States continues unabated amid accusations that China should be made accountable for intentionally misleading the world about the spread of the pandemic and allegedly impeding US efforts to prevent it spreading into the United States. There were even calls for the US Congress to legislate to strip China of its sovereign immunity and allow people who have been unemployed and the businesses that have been devastated to sue China for damages. However, China will ignore such baseless allegations and will retaliate against any action taken to hold it responsible for the pandemic.

The United States’ gripe is that China exited the lockdown much earlier than itself and is on the way to full economic recovery by the end of the year. This is the more impressive given that many analysts estimated that China’s crude oil demand lost 20% and its economy shrank by more than 6.0% in the first quarter of the year during the pandemic.

Compare this with a projected contraction of the US GDP by 11% in the fourth quarter of 2020 year-on-year. The pandemic has already cost America over 113,000 lives so far, tens of millions of jobs and trillions of dollars in lost output, income, and wealth. Moreover, the Trump administration’ handling of the pandemic was characterized by confusion, prevarications and indecisiveness about the extent of the lockdown. Contrast this with the herculean measures China took to stop the pandemic in its tracks.

And whilst the pandemic might have shown an aspect of rivalry between the United States and China, their rivalry goes far beyond it. It is about the next world order and who will emerge as the dominant power in the 21st century. It is also about the petro-yuan supplanting the petrodollar as the oil currency of the world.

The inevitable rise of China is being underpinned by the fact that it is the world’s largest economy, the growing importance of the petro-yuan, the Belt and Road Initiative (BRI) and the Russian-Chinese strategic alliance which will lead the new world order in the 21st century.

The BRI has enabled China to integrate its economy in the global trade system far deeper than the United States’. Moreover, by offering loans and helping most countries of the world modernize their infrastructure and starting wealth-creation projects, China’s economy is benefiting immensely by expanding the market for its global trade.

The COVID-19 pandemic may have hastened the day when the dollar will crash. The pandemic and the economic crisis it has triggered have sent US budget deficit soaring to a peacetime record of 17.9% of gross domestic product in 2020. The dollar will not be spared under these circumstances. The key question is what will spark the decline?

Look no further than the Trump administration. Its protectionist trade policies, its withdrawal from the Paris Agreement on Climate, Trans-Pacific Partnership, World Health Organization and traditional Atlantic alliances and its gross mismanagement of Covid-19 pandemic, together with spreading racial turmoil not seen since the late 1960s, are all painfully visible manifestations of America’s sharply diminished global leadership.

These events along with plunging domestic savings could weaken the dollar by as much as 35%. Trump’s trade war with China raises questions as who will fund the soaring US deficit if China stopped buying US Treasury bills and at what terms?

Like Covid-19 Pandemic, racial turmoil and the fall of the dollar will cast US global leadership in a very harsh light. The world is changing and the world order must be revamped. Pax Americana is virtually over and Washington must adjust to the new world.

----------------------------------------------------------------------------------------------------------------

Dr. Mamdouh G Salameh is an international oil economist. He is a leading expert on oil. He is also a visiting professor of energy economics at ESCP Europe Business School in London.