Introduction

On the 26th of March 2018 China launched its yuan-denominated crude oil futures in Shanghai thus challenging the petrodollar for dominance in the global oil market. 1

China has been planning for years to dethrone the US dollar. The truth of the matter is that China does not plan to allow the US financial system to dominate the world indefinitely. Right now, China is the number one exporter on the globe, the largest crude oil importer in the world and also the world’s biggest economy with a GDP of

$26.66 trillion in 2021 based on purchasing power parity (PPP) compared to $21.43 trillion for the US. 2

China wanted to see global currency usage reflect this shift in global economic power. The petrodollar system provides at least three immediate benefits to the United States. It increases global demand for US dollars. It also increases global demand for US debt securities and it gives the United States the ability to buy oil with a currency it can print at will. In geopolitical terms, the petrodollar lends vast economic and political power to the United States. China hopes not only to replicate this dynamic but also to establish its currency as one of the major currencies used in global financial transactions. 3

The Petrodollar vs the Petro-yuan

The Petrodollar is the money that oil-exporting nations receive from selling their oil in US dollar-denominated currency which is deposited into Western banks. The term was first coined by Egyptian-born American economist, Professor Ibrahim M Oweiss of Georgetown University in a pioneering work on petrodollar surpluses in 1974. 4

The petrodollar came into existence in 1973 in the wake of the collapse of the international gold standard which was created in the aftermath of World War II under the Bretton Woods agreements. These agreements also established the US dollar as the reserve currency of the world. Former president Richard Nixon and his then foreign secretary Henry Kissinger understood that the collapse of the gold standard system would cause a decline in the global demand for the US dollar.

Maintaining that “artificial dollar demand” was vital for the United States’ economy. So

the United States under Nixon struck a deal in 1973 with Saudi Arabia under which every barrel of oil purchased from the Saudis would be denominated in US dollars only. Any country that sought to purchase oil from Saudi Arabia would be required to first exchange its own national currency for dollars. Under the terms of the deal, the Saudis would agree to price all of their oil exports in US dollars exclusively and be open to investing their surplus oil proceeds in US debt securities. In exchange, the United States offered weapons and protection of Saudi oilfields from neighbouring countries. In 1975, all of the OPEC nations agreed to follow suit. 5

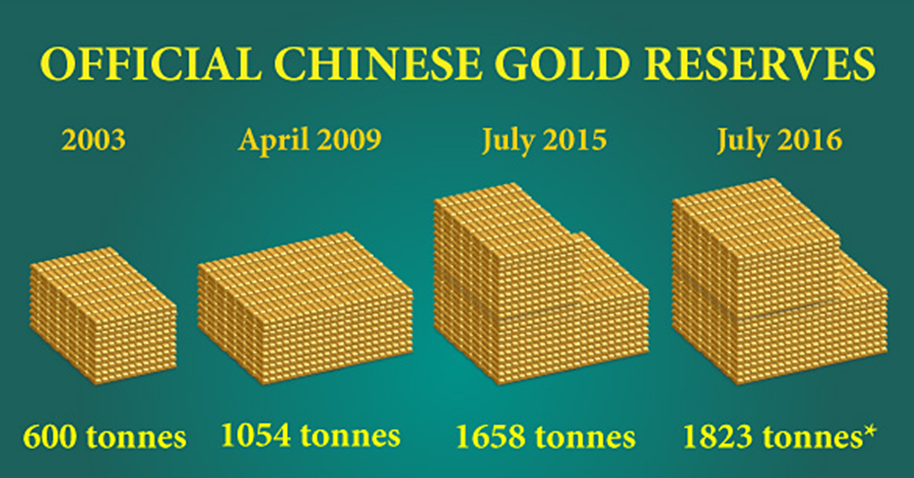

At the moment, most global trade is conducted in US dollars and more than 60% of all global foreign exchange reserves are held in US dollars. This gives the United States an enormous built-in advantage. China has started to aggressively make currency swap agreements with other major global powers and has been accumulating unprecedented amounts of gold in support of its crude oil futures contract. All of these moves are setting up the moment in the future when China will completely pull the rug out from under the US dollar (see Chart 1).

Chart 1: Chinese Official Gold Reserves, 2003-2016

Source: Courtesy of Chinese Gold Market Infographic, Bullion Star.

Today, the US financial system is the core of the global financial system. Because nearly everybody uses the US dollar to buy oil and to trade with one another, this creates a tremendous demand for US dollars around the planet. So other nations are generally happy to take US dollars in exchange for oil.

So if the US financial system is the core of the global financial system, then US debt is "the core of the core". US Treasury bonds fuel the print-borrow-spend cycle that the global economy depends upon. That is why a US debt default would be such a big deal. A default would cause interest rates to skyrocket and the entire global economic system to go haywire.

Unfortunately for the United States, US debt spiral cannot go on indefinitely. US debt is growing far more rapidly than GDP is, and therefore the debt is completely and totally unsustainable.

How Big a Threat Is the Petro-yuan to the Petrodollar?

With major oil exporters finally having a viable way to circumvent the petrodollar system, the US economy could soon encounter severely troubled waters. First of all, the dollar’s value depends massively on its use as an oil trade medium. When that is diminished, we will likely see a strong and steady decline in the dollar’s value.

Hitherto, the US dollar has had the monopoly over oil contracts as it enjoyed the status of the only currency in which major oil contracts could be made. This meant that US could get away by having an outstanding debt of $28.17 trillion as of April 2021 as it could print dollars backed by “black gold”. 6

With the petro-yuan a reality now, China is, in effect, making a claim to global oil reserves. That would definitely be against American interests as the “black gold” has been practically backing the US dollar as well as a humungous US debt. Globally, if you needed oil you definitely needed to have dollar reserves. These reserves would always land back in American economy through the banking system. Again, the same dollar would have to be competed for globally by offering goods and services to American consumers as the world is in perpetual need of oil for most of its energy needs. That means that all the economies of the world have to be constantly running for dollar while the US could print at ease in the name of national and foreign debt. 7

Could the Petro-yuan Unseat the Petrodollar?

A petro-yuan fully convertible to gold on the Shanghai and Hong Kong exchange brings a stable confidence frame to support what may very well become “Oil for Gold” or “Petro-yuan for Gold”.

But it won’t be easy to unseat the petrodollar without the participation of the world’s two top oil producers, Russia and Saudi Arabia. Between them Saudi Arabia and Russia account for 26% of global oil production and 25% of oil exports. Russia is already on board along with Iran and Venezuela. 8

A more significant development was Russia agreeing to some yuan-based oil trade in 2015. Angered by US sanctions, the Russians began undermining the petrodollar by settling more oil contracts in Asian currencies, especially the Chinese yuan, the Hong Kong dollar and Singapore dollar. 9

China is now trying to persuade Saudi Arabia to start accepting the petro-yuan for its crude oil. If the Chinese succeed, other oil exporters could follow suit.

Saudi Arabia exported currently sells on average 1.50 million barrels of oil a day (mbd) to China. Russia is still the top supplier to China, exporting 1.67 mbd. In fact, Russia has been taking market share away from Saudi Arabia in China. If Riyadh wants to avoid losing more ground, it may have to agree to petro-yuan sales. For Saudi Arabia, it will find itself between a rock and a hard place – lose the Chinese market or spark the ire of Washington.

Saudi Arabia might end up accepting the petro-yuan for crude oil exported to China and the Asia-Pacific countries, the Euro for its exports to the European Union (EU) and the petrodollar for exports to the United States. Even such a compromise will still tip the balance in favour of the petro-yuan since 75% of Saudi oil exports go to China and the Asia-Pacific region.

For China, there is a lot of upsides to this gambit. An oil futures market based in petro-yuan will stimulate demand for the Chinese currency, which China believes will lend it strategic clout. That money is also more likely to be recycled back into the Chinese economy. The US has been able to run huge budget deficits, borrowing money at extremely low rates because of the demand for its currency. Petrodollars continuously flow back into the US economy, creating investment and economic growth that might not otherwise occur. The dollar has also long been one of the premier safe havens for investors around the world. China would like to emulate that dynamic.

Could US Sanctions Accelerate the Rise of the Petro-yuan?

Indiscriminate US sanctions against countries whom the United States wants to punish for one reason or another are undermining the petrodollar and enhancing the petro-yuan.

Iran, Venezuela, Syria, North Korea, Russia and China are just few examples of the reckless US policy misadventures. But these countries are fighting back and very successfully. The latest cosying up of China and Iran is hugely undermining both US sanctions and the petrodollar.

China has become Iran's most important commercial partner after the two countries signed a 25-year strategic partnership last week. The deal is touted as being worth between US$400 billion and US$600 billion, including an expansion of China's presence in Iranian banking, telecommunications, infrastructure and the Iranian oil and gas industry.

For a period of 25 years, China shall invest approximately $280 Billion in the development and maintenance of Iran’s oil and gas facilities. In return, China may get a discount of up to 25% per barrel for its Iranian crude oil imports.

And with this historic milestone, the fulcrum of the global oil politics thus quietly tilted by a gradient to the advantage of the leading importer’s currency, namely the petro-yuan. It is not entirely unfathomable that every time the US imposes sanctions against an oil producing country, the sanctioned country may welcome it heartily. Who would have known that being obliged to China through a massive yuan debt, may be the most pragmatic egress out of US sanctions?

Other than Iran, a string of energy-rich economies appear to be moving closer into China's orbit, expanding economic ties and potentially fuelling the rise of the petro-yuan. 10

It would be a policy goal for both China and those Arab Gulf States to be able to use an alternative to the petrodollar. If they do use the petro-yuan, the currency would become more important as part of the global financial system.

China is the biggest importer of Saudi crude. It could pay for its Saudi crude imports in petro-yuan while Saudi Arabia will buy better yielding bonds.

The petrodollar's advantage as a reserve currency might be starting to wane amid US sanctions on multiple countries, with regional trade partners or foreign production companies seeking to limit risk exposure to the dollar and dollar-centric monetary system. 11

The petro-yuan could emerge as an attractive alternative, allowing business to be exclusively conducted in the Chinese currency to safeguard finances from US foreign policy and sanctions.

China and Russia have already been forging rouble-yuan deals to ditch the US dollar and use local currencies in international trade. The share of dollars in Russian exports to China plunged to 39% in 2019 from 75% in 2018 according to data provided by ING Bank, reflecting a shift in invoicing of oil contracts into euros. Similarly, the share of dollars in Chinese imports from Russia declined to 61% in 2020 from 72% in 2018, reflecting the increasing roles of the euro and yuan. 12

Russia's central bank holds around $68 billion yuan in foreign exchange reserves, about 14% of its total, suggesting upside potential for use of the yuan in Russian trade and financial flows.

Another way to assure de-dollarization is better cooperation in the banking sector. Chinese banks are present on the Russian market, but their share is quite low at the moment.

Saudi Aramco said last month it would make sure that China's energy security is its highest priority for the next 50 years. This statement does indicate that the petro-yuan is likely to be used for the payment of Saudi oil exports to China. If that happens, more oil trading will be using the petro-yuan. But there are still a number of obstacles, including restrictions on the yuan's convertibility and the tricky relationship with the US.

It's unlikely that we will see Saudi Arabia move away from the dollar given that this would only hurt the relationship between the two countries. While there is the potential to see some Saudi flows to China transacted in petro-yuan, the petrodollar will remain for the time being the preferred currency of choice for the Saudis.

The Bank of China last week pledged to enhance the yuan's exchange rate flexibility, signalling less policy resistance towards recent movements in the currency.

Bilateral agreements between China and oil producing nations that are settled in yuan, as well as an increase in yuan-denominated contracts used for hedging and speculation, could see a significant rise in the petro-yuan in coming decades.

Big shifts in financial markets tend to take a lot longer to develop but once they occur, they could move fast leading to a regime change very quickly.

While the petrodollar has been the traditional currency in the global oil market, it has now to share the limelight with the petro-yuan and other major major currencies.

Top 5 countries opting to ditch US dollar & the reasons behind their move

The past year was full of events that inevitably split the global geopolitical landscape into two camps: those who still support using US currency as a universal financial tool, and those who are turning their back on the greenback in what is being described as the phenomenon of de-dollarization. 13

Global tensions caused by economic sanctions and trade conflicts triggered by Washington have forced targeted countries to take a fresh look at alternative payment systems currently dominated by the US dollar.

1-China

The ongoing trade war between the United States and China, as well as sanctions against Beijing's biggest trading partners have forced China to take steps towards reducing its economy’s dependence on the US dollar.

The Bank of China has been regularly reducing the country's share of US Treasuries. China, the biggest holder of US treasury bills has been cutting its share to the lowest level since May 2017.

Instead of promptly dumping the greenback, China is trying to internationalize its own currency, the yuan, which was included in the IMF basket of reserve currencies alongside the US dollar, the Japanese yen, the euro, and the British pound. Beijing has recently made several steps towards strengthening the yuan, including accumulating gold reserves, launching yuan-priced crude futures, and using the currency in trade with international partners.

As part of its ambitious Belt and Road Initiative (BRI), China is planning to introduce swap facilities in participating countries to promote the use of the yuan. Moreover, China played a pivotal role in the formation of a free-trade agreement called the Regional Comprehensive Economic Partnership (RCEP) signed on 15 November 2020, which include the countries of Southeast Asia. The 16-member trade pact accounts for 43% of world’s population (3.4 billion) and 54% of global GDP ($49.5 trillion) making it the biggest trade bloc in history. 14 The trade pact could easily replace the Trans-Pacific Partnership (TPP), the proposed multi-national trade deal which was torn up by former US President Trump shortly after he took office.

India

In the aftermath of US sanctions on Iran, India had to switch to the rupee to pay for its purchases of Iranian crude. In 2019, India and the United Arab Emirates sealed a currency-swap agreement to boost trade and investment using their national currencies.

Taking into account that India is the world’s third-largest country by purchasing power parity, steps of this kind could considerably diminish the role of the dollar in global trading.

Turkey

In 2019, Turkish President Recep Tayyip Erdogan announced plans to end the US dollar monopoly via a new policy that is aimed at non-dollar trading with the country's international partners. Later, Turkey's leader announced that Ankara is preparing to conduct trade through national currencies with China, Russia and Ukraine. Turkey also discussed a possible replacement of the US dollar with national currencies in trade transactions with Iran. The move was prompted by political and economic reasons.

Iran

Sanctions have forced Tehran to look for alternatives to the US dollar as payment for its oil exports. Iran clinched a deal for oil settlements with India using the Indian rupee. It also negotiated a barter deal with neighbouring Iraq. The partners are also planning to use the Iraqi dinar for mutual transactions to reduce reliance on the US dollar amid banking problems connected to US sanctions.

Russia

Russia had to dump its holdings of US Treasuries in favour of more secure assets, such as the ruble, the euro, and precious metals.

The country has already taken several steps towards de-dollarizing the economy due to the constantly growing burden of sanctions that have been introduced since 2014.

So far, Moscow has managed to partially phase out the greenback from its exports, signing currency-swap agreements with a number of countries including China, India and Iran. Russia has recently proposed using the euro instead of the US dollar in trade with the EU.

Growing Use of the Chinese Yuan for Global Payments

Payment in Yuan jumped from a year earlier according to data from the Society for Worldwide Interbank Financial Telecommunications, which handles cross-border payment messages for more than 11,000 financial institutions in 200 countries. Despite the increase, the yuan accounts for about 2.4% of the market versus the dollar at 38%. 15

The dollar maintained its top spot in the ranking, although its share slipped from the previous month. The euro followed with 37%, while the pound remained in third. The yen rounded out the top four (see Table 1).

The yuan was ranked 35th in October 2010 when Swift started tracking currencies. It progressed to the top six in 2014, where it has generally averaged slightly less than a 2% share globally. It has managed to retain the fifth spot in the past three months.

Turnover for the yuan versus the dollar in London, the world’s biggest currency hub, rose to a record $84.5 billion in October, according to data released last month by the Bank of England. That was up 56% from April 2020. 16

The dollar still accounts for almost 60% of official foreign-exchange reserves.

Table 1: Ranking of the World’s Five Reserve Currencies

|

CURRENT RANK |

CURRENCY |

JAN. 2021 |

DEC. 2020 |

JAN. 2020 |

|

1 |

USD |

38.26% |

38.73% |

40.81% |

|

2 |

EUR |

36.60% |

36.70% |

33.58% |

|

3 |

GBP |

6.80% |

6.50% |

7.05% |

|

4 |

Yen |

3.49% |

3.59% |

3.32% |

|

5 |

Yuan |

2.42% |

1.88% |

1.65% |

Source: Courtesy of Bloomberg

Global Oil Trade

A petro-yuan fully convertible to gold on the Shanghai and Hong Kong exchange brings a stable confidence frame to support what may very well become “Oil for Gold” or “Petro-yuan for Gold”.

In 2019 the year before the pandemic hit the global economy, value of the global oil trade was estimated at almost $1.94 trillion based on 71.0 million barrels a day (mbd) traded at $75 a barrel. 17

The petrodollar accounted for an estimated $1.16 trillion or 60% while the petro-yuan, a late newcomer accounted for an estimated $564 bn or 29%. This was achieved in a period of three years since the launch of the petro-yuan.

The petrodollar’s share has been declining from 100% market share when it was introduced in 1973 to an estimated 60% now. It is possible that the introduction of the petro-yuan will accelerate the decline further.

Conclusions

The launching of the crude oil benchmark on the Shanghai exchange could mark the beginning of the end of the overwhelming dominance of the petrodollar in the global oil market.

It is probable that the Chinese yuan will emerge as the world’s top reserve currency within the next two decades with the petro-yuan dominating global oil trade.

The upward trajectory of the petro-yuan will be underpinned by China’s growing international trade, the BRI deepening the integration of China’s economy into the global trade system, China’s becoming the driver of global oil demand and its strategic alliance with Russia, the world’s energy superpower.

Still, the petrodollar will remain a significant power to be reckoned with as a reserve currency and as a petrodollar well into the future.

*Dr Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting professor of energy economics at the ESCP Europe Business School in London. Bottom of Form

Footnotes

- Mamdouh G Salameh, “Will the Petro-yuan Be the Death Knell for the Petrodollar?” USAEE Working Paper No: 18-338 posted on 17 April 2018 and accessed at http://ssrn.com/abstract=3157740 on 18 May 2021

- World Bank data. Accessed on 17 May 2021.

- Mamdouh G Salameh, “Will the Petro-yuan Be the Death Knell for the Petrodollar?”

- Ibrahim M Oweiss, “Petrodollars: Problems & Prospects” (a paper given at the Conference on ‘The World Monetary Crisis’, Colombia University, March 1-3, 1974).

- James D Hamilton, “Historical Oil Shocks” Department of Economics. University of California, San Diego. Revised: February 1, 2011. Accessed on 16 May 2021.

- com. Accessed on 16 May 2021.

- Saad Awan,”Petro-yuan” Pakistan Today, 24 February 2018, accessed at pakistantoday.com.pk/2018/02/24/petro-yuan on 28 March 2018.

- BP Statistical Review of World Energy, June 2020, p16-21.

- Mamdouh G Salameh, “Will the Petro-yuan Be the Death Knell for the Petrodollar?”

- Smriti Chaudhary, “Petrodollar vs Petro-yuan: Is China Set to Replace US as the Biggest Player in M, East as Ties Grow with Saudi Arabia?” The EurAsian Times, 15 May 2021, accessed on 16 May 2021.

- Bheki Gila and Zwelakhe Gila, “The PetroYuan vs the PetroDollar: The Greater Game”, IOL Business Report / Energy, 3 August 2020, accessed on 17 May 2021.

- South China Morning Post, 3 April 2021, accessed on 15 May 2021.

- An Economic Report aired on RT Satellite TV on 2 Jan, 2019 and accessed on 15 May 2021.

- Ibid.

- Susanne Barton, “Yuan Popularity for Global Payments Hits Five-Year High”, Bloomberg 18 February 2021. Accessed on 16 May 2021.

- Ibid.

- Estimated value of daily crude oil exports by Russia, Iran and Venezuela and daily crude oil imports by China based on data from the 2020 issue of BP Statistical Review of World Energy (page 30) and an oil price of $75 a barrel.

-------------------------------------------------------------------------------------------------------------------------------------------

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil.

He is also a visiting professor of energy economics at ESCP Business School in London.

Disclaimer: "The contents of this article are the author's sole responsibility. They do not necessarily represent the views of the Hellenic Association for Energy Economics or any of its Members".