Since early December crude oil prices have staged an impressive comeback. Brent crude oil price has shot up from $40 a barrel in early December to $67.20 on 25 February 2021. The question is how high oil prices are destined to go this year and next.

Some of the world’s biggest names in investment banking, oil trading and analysis can’t seem to get on the same page when it comes to predicting what will happen next for the volatile commodity.

Some, like Goldman Sachs and JPMorgan, are confident that oil is ready for the next supercycle —a prolonged rise in the price of oil. And when they refer to this rise, they’re talking $80 or even $100 per barrel.1 Others think that talk of this next supercycle may be a bit hasty.

The sudden talk about supercycle predictions is motivated by the impressive and sustained surge in oil prices since early December and the impact of economic stimulus packages by governments of the major economies.

Other than the economic stimulus packages, oil prices will be underpinned in 2021 and the coming years by a return of the global economy to normal business activities as a result of the global rollout of anti-COVID vaccines, a fast-depleting global oil inventories, almost complete compliance by OPEC+ with the production cuts, the insatiable thirst of China and India for oil, the global oil industry’s investments and US shale oil industry.

The Role of Economic Stimulus Packages

Governments of the major economies in the world have been focusing on assisting existing businesses weather the crisis and save jobs. In the United States, President Joe Biden unveiled a $1.9 trillion fiscal stimulus plan. The EU’s two largest economies Germany and France also announced economic packages estimated at 130 billion euros and 100 Billion euros respectively focusing on green technology investment, more support for workers and firms, and industrial policy reforms.2

By contrast, most developing countries are burdened by deficits and cannot borrow readily to finance such programmes. Instead, many are following the pattern of Brazil, China, India, and Russia (BRICs) and spending on infrastructure rather than on business and income support.

The four BRICs are at different stages in recovery. China is the only major economy in the world to record growth in 2020. The International Monetary Fund (IMF) forecasts an economic growth of 8% for China, 8.3% for India and 4.1% for Russia in 2021. Brazil lacks a recovery with its economy shrinking by 9.1% in 2020 and remaining stagnant in 2021.

The BRICs’ approach to recovery relies largely on stimulating investment through

Large scale infrastructure projects. This makes sense as governments can decide how many kilometres of railway or roads to build and do so through emergency procurement procedures. As examples of infrastructure projects, China is building 4,000 km of railway in 2020-21, half for high-speed trains. Russia has announced a programme for upgrading the Trans-Siberian railway, a dozen Siberian airports, and three Black Sea ports by 2024. Brazil and India plan to finance infrastructure investments by attracting foreign direct investment (FDI) and generating additional revenues from privatizing state-owned companies.3

The global economy is projected to grow by an estimated 5.4% in 2021 and 3.7% in 2022 led by emerging markets particularly China and India.4

And with a probable end to the trade war between the US and China and a possible de-escalation of tension between Iran and the United States and also in the Eastern Mediterranean, the world and the global economy will get a breather to readjust to the post-pandemic era.

Return of the Global Economy to Business as Usual

2020 will enter history books as the year of the COVID-19 pandemic which has inflicted the biggest damage on both the global economy and the global oil market since the Great Depression of 1929.

The pandemic was a crisis like no other according to Kristina Georgieva, Managing Director of the IMF, causing the global economy to shrink by 4.4% in 2020 which would mark the worst downturn since the Great Depression and sending an additional 114 million people into extreme poverty, defined as living on less than $1.90 a day.5 Furthermore, it has led to a virtual collapse of the global oil and gas industry particularly US shale oil industry causing global oil demand to decline by an estimated 30 million barrels a day (mbd) or 30% of pre-pandemic demand of 101 mbd.6

The global rollout of vaccines has raised hopes that the global economy will soon return to normal economic activities. Crude oil prices have been responding to these sentiments by staging impressive gains with Brent crude rising from $40 a barrel in early December last year to more than $67 in 25 February 2021.

Furthermore, an accelerating depletion of global oil inventories from 1.4 billion barrels at the height of the pandemic to an estimated 100 million barrels now has been strengthening both global oil demand and prices.

The China Factor

The pandemic has highlighted China’s role as the undisputed driver of both the global economy and the global oil demand. China was the first to go into lockdown and also the first to exit it.

China’s spectacular rebound has been instrumental in both the surge in global oil demand and prices. China will continue to be the real driver of both the global economy and global oil demand well into the future aided by India.

Its speedy rebound has astounded the world coinciding with the shutting down of most of the world’s economy. Moreover, China’s crude oil imports broke all previous records averaging 11.67 mbd in 2020, 14% higher than in 2019 despite the pandemic.7

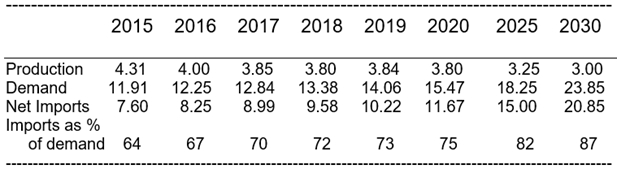

Since it became a net oil importer in 1993, China has greatly increased its oil imports from 20,000 barrels a day (b/d) then to an average of 11.67 mbd in 2020 accounting for 75% of its consumption and this is projected to rise to 87% by 2030 (see Table 1).

Table 1

China’s Crude Oil Production, Consumption & Imports

(mbd)

Sources: BP Statistical Review of World Energy, June 2020 / 2019 OPEC Annual World Oil Statistical Bulletin / Oilprice.com / Authors estimates.

The IMF projects that China’s and India’s economies will grow this year at 8% and 8.3% respectively.

Continued OPEC+ Production Cuts

OPEC+’s continued production cuts amounting currently to 7.0 mbd have played a pivotal role in underpinning crude oil prices by ensuring a fast depletion of global oil inventories.

Only OPEC+ stood between the destructive power of the pandemic and the collapse of the global oil market and the whole oil industry. OPEC+’s efforts have saved the day and earned worldwide acknowledgement even grudgingly by the United States.

And with rising oil prices OPEC+ will assess the market during its meeting on March 4 and adjust its production cuts to ensure that a demand-supply balance exists in the market.

The claim that Saudi Arabia and Russia are headed for another clash on OPEC+ oil cuts is totally untrue.

Still, the oil strategies of the leaders of OPEC+, namely Russia and Saudi Arabia will diverge with rising oil prices because Russia’s economy can easily live with an oil price of $40 a barrel or less whilst Saudi Arabia and the overwhelming majority of OPEC+ members need an oil price higher than $80 to balance their budgets. And whilst Russia believes that an oil price ranging from $60-$65 can delay a comeback of US shale oil production, Saudi’s and other OPEC members’ motivation is to get prices as close as possible to $80 or even higher.

The Oil Industry Is in Dire Need of Investment

After several years of being bombarded by peak oil demand or oil glut scenarios, the market is without any doubt heading towards a major supply crisis. The COVID-era has not only decimated short-term demand and increased interest in a global energy transition, it has also brought down global upstream investments. Demand is likely to grow by at least 10 mbd from current levels. So where are these additional volumes going to come from? With upstream investment faltering, it remains unclear how this demand will be met.8

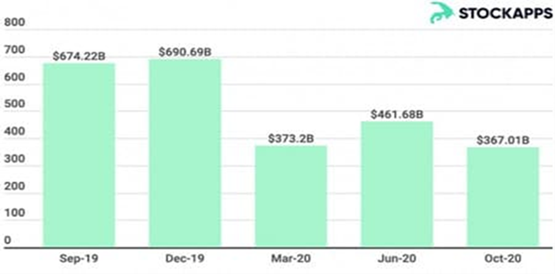

During the pandemic, international oil companies have seen a steep decline in their revenues, market value, and interest from institutional investors. In October 2020 the combined market cap of the top five oil companies in the U.S. fell by 47% from $690 bn in December 2019 to $367 bn in march 2020 (see Chart 1).

Chart 1

Source: Courtesy of Oilprice.com on 12 January 2021

It wasn’t only COVID that was responsible for this drop but also global macro-economic drivers such as the U.S.-China trade war and continuing oil overproduction. A significant indicator of just how much the industry was suffering was the removal of American oil supermajor ExxonMobil, once the world’s largest publicly traded company, from the Dow Jones Industrial Average in August 2020. Exxon suffered a huge market cap drop in 2020, falling from $300 bn in September 2019 to $144 bn in October 2020.9

European oil and gas companies didn’t fare better in 2020. Almost all European oil and gas companies have seen a market capitalization crash in 2020. Supermajors Shell’s and BP’s market value declined by declined by 33.5% and 34.5% respectively.

2021 could be a watershed year for oil markets. Falling investments and bankruptcies will create a supply crunch the likes of which we have never seen before. With an ever-growing list of delayed upstream projects and FIDs, the threat is growing. As OPEC has indicated before, investment volumes of around $12.6 trillion are needed to keep the oil supply for the coming decades at the current level.

The pandemic forced the global oil industry to defer as much as $131 billion worth of oil and gas projects which were slated for approval in 2020. This event alone could create a supply deficit estimated at 10-15 mbd in 2022/3 and see Brent crude price rise beyond $100 if the deferment decision isn't reversed soon. This should be followed with further investments estimated $380 bn annually for the foreseeable future.10

Weakening US Shale Oil Industry

The US shale oil industry was devastated by the pandemic. It was the most hit industry. It will emerge from the pandemic leaner and weaker but will continue to need a life support machine paid for by American taxpayers to survive.

Since its inception, the US shale oil industry’s work ethics was characterized by greed and irresponsible production aimed at undermining OPEC+ efforts to prop oil prices and also gain market share at its expense. But that approach has resulted in increasing numbers of bankruptcies, mounting debts estimated at hundreds of billions of dollars and a loss of investors’ confidence culminating in a virtual collapse during the pandemic.

Former President Trump encouraged shale oil drillers to put geopolitics ahead of economics. He urged them to adopt empty slogans of his discredited “America First Policy” such as ‘achieving US energy dominance’, ‘making America oil self-sufficient’ and ‘claiming America the world’s largest crude oil producer’ thus encouraging them to produce recklessly and in so doing destabilizing the global oil market and prices and accelerating the eventual demise of their industry.

I have calculated that US shale oil production lost an estimated 6.5 mbd as a result of the pandemic. Moreover, it lost its importance to the global oil market. This will be translated into rising US crude oil imports from 9 mbd currently to 12-13 mbd in the following years.

And with a breakeven price of between $60 and $65 a barrel for most drillers, US shale oil could hardly expect to stage a comeback soon.

The crucial situation facing the shale oil industry is that its fate is now in the hands of OPEC+. Were OPEC+ to end its production cuts for any reason, prices will fall and this will immediately and very adversely impact on shale oil production.

How High Would Oil Prices Go?

The oil prices rally since December last year has been impressive with Brent crude rising from $40 a barrel then to more than $67 now, a 68% thus matching levels that haven’t been seen since 2019. The key driver is recovering demand exerting pressure on supplies and creating a shit in the market from a situation known as “contango”, a market condition where the futures price of a commodity is higher than the expected spot price of the contract at maturity to a situation known as “backwardation”, a market condition where the price of a commodity’s forward or futures contract is trading below the expected spot price at contract maturity. This is bullish for long term crude prices.11

One of the keys to this support for crude is the drawing down of inventories, both in the U.S. and globally. The fall in inventories has happened at a faster pace than most experts thought possible and helped to create concern about future supplies thus pushing prices higher now. We are certainly not short of oil at this point but the shift from ‘contango’ to ‘backwardation’ is noteworthy for the market.12

Oil prices are now definitely in a bull market. The sustained surge in oil prices since December has given rise to speculation that oil prices are now in a supercycle, defined as a protracted upward rise in prices due to a structural shift in the way demand outpaces supply.13 On the other hand, what is being described as a supercycle could be a great pent-up force which both the global economy and global oil demand were unable to release while the pandemic was raging.

Still, there is evidence to suggest a new commodities supercycle could be starting with an inflection point approaching that would shorten the time between the peaks and valleys of the multi-year cycle.14

For example, precious and strategic metals particularly copper have gone through the roof this year and may still have more room to run. Copper, arguably the most critical of industrial metals, has burst beyond $9,000/mt for the first time in a decade. There is a risk copper could more than quadruple in value, taking oil prices into triple digits.15

OPEC+ will have an important say in how the supercycle plays out in the way it responds to rising prices. OPEC+ countries will also want to increase market share and reap the rewards. A fine line will need to be walked between easing production cuts without it unravelling.

While the seeds of a supercycle are being sown in 2021, whether it will bloom in later years remains very much dependent on choices still to be made by OPEC+, energy companies and policy makers in the months ahead.

Since China exited the lockdown in May 2020 I have been projecting repeatedly in my comments to oilprice.com that Brent crude oil price will hit $40-$50 a barrel in the last quarter of 2020. Brent ended the year at $51.

I also projected at the same time that Brent will rise to $60 in the first quarter of 2012. The price rose above $67. Equally I also projected that Brent will rise further to $70-$80 in the third quarter and average $65 in 2021 with global oil demand returning to pre-pandemic level of 101 mbd by the middle of this year.

Based on the various factors I outlined before, I am now projecting that we will see $100 oil by the second half of 2022 or the first quarter of 2023.

Conclusions

2021 could be the year that the global economy’s growth will accelerate and recoup virtually all its losses with global oil demand witnessing a speedy growth. Oil prices could therefore go as high as the fundamentals in the global oil market would allow them.

Crude oil is now in a bull market expected to last for at least a few years and therefore its surge is unstoppable. Prices are merely reflecting a great pent-up force which both the global economy and global oil demand were unable to release whilst the COVID-19 was raging. Whatever the reason, crude oil prices have a very long way to go with $100 oil in sight.

Footnotes

- “$100 Oil: Big Banks Believe a New Oil Supercycle Is Beginning”, posted on oilprice.com on 16 February 2021 and accessed on 16 February 2021.

- Mamdouh G Salameh, “The Post-COVID-Pandemic World: What Could the Global Economy & the Oil Industry Expect?” posted by the ESCP’s Energy Management Centre on 19 February 2021.

- Ibid.,

- Mamdouh G Salameh, “A Game-changing Oil Pipeline That Strengthens Iran’s Geopolitical Reach (An Article posted by the Hellenic Association for Energy Economics (HAEE) on 1 February 2021).

- Martin Crutsinger, “A Crisis Like No Other: IMF Warns Global Economy Could Be Permanently Scarred” published by the Sydney Morning Herald on 16 October 2020.

- Mamdouh G Salameh, “The Post-COVID-Pandemic World: What Could the Global Economy & the Oil Industry Expect?”.

- Based on figures published regularly by Oilprice.com and accessed by the author.

- “The Oil Industry Is in Dire Need of Investment” posted on oil price.com on 12 January 2021 and accessed on 12 January 2021.

- Ibid.,

- Ibid.,

- “How Much Higher Can Oil Prices Go?” posted on oil price.com on 10 February 2021 and accessed on 10 February 2021.

- Ibid.

- Paul Hickin, “Crude Oil’s Fate Could Be in Hands of Commodity Supercycle”, Business Standard, London 25 February 2021.

- “This Commodity Super-Cycle Could Be Unlike Anything We Have Seen Before”, posted on oilprice.com on 17 February 2021 and accessed on 17 February 2021.

- Paul Hickin, “Crude Oil’s Fate Could Be in Hands of Commodity Supercycle”.

-------------------------------------------------------------------------------------------------------------------------------------------

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil.

He is also a visiting professor of energy economics at ESCP Business School in London.

Disclaimer: "The contents of this article are the author's sole responsibility. They do not necessarily represent the views of the Hellenic Association for Energy Economics or any of its Members".