2020 will enter history books as the year of the COVID-19 pandemic which has inflicted the biggest damage on both the global economy and the global oil market since the Great Depression of 1929.

2020 started with positive projections that the global economy is set to grow at 3.3% with global oil demand adding 1.2 million barrels a day (mbd) over 2019. But this was not to be. The pandemic changed everything. 2020 will end up with the global economy having lost 8 percentage points of growth and a global oil market that is starting to recover cautiously from a destruction of 30% of oil demand or 30 mbd and a glut which at the height of the pandemic grew to 1.8 bn barrels.

And despite the doom and gloom, 2020 will end with a glimmer of hope that the newly developed anti-COVID vaccines will put an end to the pandemic thus enabling both the global economy and the global oil market to recoup all their losses.

2020 is also heralding the triumph of OPEC+ over US shale oil, the emergence of China as the top driver of the global economy and oil demand, calls for a new world order and a new administration in the White House that will replace Trump’s discredited "America First" strategy with a return to policies based on global mutual interests and grounded in international institutions.

The Triumph of OPEC+

September 14, 2020 marked the sixtieth anniversary of the Organization of the Petroleum Exporting Countries or OPEC — almost two thirds of a century of existence characterized by embargo, conflict and even wars. But the biggest challenge OPEC has ever faced since its founding was the pandemic.

Only OPEC+ stood between the destructive power of the pandemic and the collapse of the global oil market and the whole oil industry. Yet, it emerged victorious. Its huge production cuts of almost 10 mbd put a solid floor under oil prices and prevented them from sinking below $20 a barrel and also saved the global oil market. OPEC+’s efforts were acknowledged worldwide even grudgingly by the United States.

OPEC at last achieved a decisive victory over US shale oil. The pandemic has led to a virtual collapse of US shale oil production and the importance of shale oil to the global oil market. The US shale oil industry will eventually emerge from the pandemic smaller and leaner but it will continue to need a life support machine provided by US taxpayers to keep it alive. With outstanding debts approaching $1 trillion and a breakeven price of between $60 and $65 a barrel for most drillers, US shale oil could hardly expect to stage a comeback soon.

The vaccine breakthrough and OPEC+ cuts caused Brent crude oil price to surge above $50 for the first time since January 2020. And with the start of global vaccination, prices could be expected to hit $60 in the first quarter of 2021 rising to $70-$80 by the third quarter. The trajectory will take prices to $100 by 2024.

The Continuing Rise of China

The pandemic has highlighted China’s role as the undisputed driver of both the global economy and the global oil demand. China was the first to go into lockdown after the coronavirus outbreak but it was also the first to exit it.

Its speedy rebound has astounded the world coinciding with the shutting down of most of the world’s economy. Moreover, China’s crude oil imports broke all previous records averaging 11.67 mbd during the first ten months of 2020, 12.7% higher than the same period in 2019 despite the pandemic.

Three quintessential objectives will continue to occupy China’s strategic thinking well into the future. The first is securing its oil and energy needs peacefully. The second is ensuring its energy security and the third objective is dethroning the petrodollar and replacing it with the petro-yuan as the global oil currency. All three objectives are directly connected with oil and energy.

The struggle between the world’s third largest oil producer (the United States) and the world’s biggest oil importer (China) will have huge implications for the entire world’s energy markets and the global economy in general.

The most recent battlefield is Iraq, the second largest oil producer in OPEC after Saudi Arabia. China’s interest in buying ExxonMobil’s 32.7% stake in Iraq’s supergiant West Qurna 1 oilfield will result in its control of three of Iraq’s supergiant oil fields, namely Majnoon, Rumaila and Qurna 1 oilfields. And by taking over the contract for the crucial Common Seawater Supply Project (CSSP) which ExxonMobil isn’t keen to go ahead with, China will virtually be in control of Iraq’s oil industry. The CSSP is pivotal for Iraq’s plans to raise its production to a minimum of 7 mbd and a maximum of 12 mbd by transporting sea water from the Persian Gulf to oil production facilities to boost the pressure and recovery rates at key oil reservoirs in Iraq.

The Emerging New World Order?

More than two centuries ago, Napoleon Bonaparte uttered a wise dictum that “China is a sleeping giant. Let her sleep, for when she wakes she will move the world’. Now this giant is hell-bent on dethroning the United States as the ‘indispensable superpower’ and establishing a new world order.

During his four years in the White House, President Trump has placed blame squarely on China for a wide range of grievances including intellectual property theft, unfair trade practices and recently, the COVID-19 pandemic. Trump even insisted on calling the pandemic the “China virus” and vowed that China is going to pay for what the pandemic has done to the United States. Early on he started a trade war against China.

The Pandemic may have sharpened the race for a new world order. And whilst it may have shown an aspect of rivalry between the United States and China, their rivalry goes far beyond the pandemic. It is about the next world order and who will emerge as the dominant power in the 21st century. It is also about the petro-yuan supplanting the petrodollar as the oil currency of the world.

The inevitable rise of China is being underpinned by the fact that it is the workshop of the world, the growing importance of the petro-yuan, the Belt and Road Initiative (BRI) and the Russian-Chinese strategic alliance.

The BRI has enabled China to integrate its economy in the global trade system far more than the United States’. Moreover, by offering loans and helping most countries of the world modernize their infrastructure and starting wealth-creation projects, China’s economy is benefiting immensely by expanding the market for its global trade. China’s economy is the world’s largest estimated in 2020 at $29.5 trillion based on purchasing power parity (PPP) compared with $21.5 trillion for the United States.

The Election of Joe Biden as US President

Under President Trump, the world has been one of "America First" nationalism, ditching international agreements that he believed gave the US a raw deal.

Under Joe Biden, the United States is expected to return to policies based on mutual global cooperation and benefits and grounded in international institutions.

At the top of Joe Biden's to-do list is to control the pandemic in America and attend to the US economy which had shrunk by 32.9% in the second quarter of 2020 and still contracting.

President-elect Biden will also focus his attention on repairing strained relationships with allies, especially NATO and the European Union (EU) and re-joining the Paris Climate Agreement, which is one of the international accords that Trump dumped.

Afterwards he will have to deal with the unfinished trade war with China, Iran’s nuclear deal and the crippling crisis in Venezuela.

1-Relations with China

The intensifying anti-China rhetoric in the United States and direct attacks on China by President Trump during the presidential elections meant that he was preparing to break the truce reached in December 2019 and resume the trade war immediately after the US exits the lockdown. However, he lost the elections.

The measures he has taken recently to extend the United States’ blacklist of Chinese companies which are allegedly military-controlled are intended to escalate tensions with China before President-elect Biden takes office thus making it difficult for Biden to improve relations with China and end the trade war.

Still, the trade war is not principally about oil or China’s trade surplus and alleged Chinese malpractices. It is about the petro-yuan undermining the supremacy of the petrodollar and by extension the US financial system, Taiwan, refusal by China to comply with US sanctions against Iran and Venezuela, China’s overwhelming dominance in the Asia-Pacific region and its sovereignty claim over 90% of the South China Sea, the new order in the 21st century and above all fear of the US losing its unipolar status.

A Biden administration will probably try to improve relations with China by removing tariffs on Chinese exports and ending the trade war in return for viable agreements on technology transfer, intellectual property and other issues.

2-Iran’s Nuclear Deal

Tensions between Washington and Tehran have escalated following Trump’s withdrawal in 2018 from the landmark 2015 Joint Plan of Action, or JCPOA accord (better known as the Iran nuclear deal) and the re-imposition of harsher sanctions on Iran. In response Iran has stopped observing some of the restrictions on its nuclear activity.

Joe Biden says he's prepared to re-join the Iran nuclear deal if Iran returns to strict compliance - but he wouldn't lift sanctions until then. He added that Trump’s "maximum pressure" policy has failed while Iran is now closer to a nuclear weapon than it was when Trump came to office.

I doubt very much that Iran would be prepared to renegotiate the deal without the United States lifting the sanctions first or at least easing them significantly. This is something the United States may not accept to do and therein lies the rub.

Moreover, Biden will come under intensive pressure from Israel and US allies in the Arab Gulf not to re-join the nuclear deal or lift the sanctions. Whether under Trump or Biden or any other US president, Israel comes first in US strategic calculations even ahead of US own interests. So nobody should bank on a lifting or even easing sanctions on Iran soon.

3- Venezuela’s Crippling Crisis

Whilst the very harsh US sanctions have managed to exacerbate the hardships and the misery of the Venezuelan people, they have failed miserably to effect a regime change or cripple Venezuela’s economy or oil industry.

And despite the intrusive sanctions, Venezuela, like Iran, has perfected the art of evading US sanctions and has been managing to export almost 1 mbd openly and also via covert means.

A Biden administration may lift the sanctions on Venezuela or at least ease them on humanitarian grounds so as to open the way for a political resolution of the crisis.

A Glimmer of Hope

The news that effective anti-COVID vaccines are now available and the start of global vaccination are already invigorating the global economy and raising hopes of mankind that an end of the pandemic is near.

Furthermore, the speed by which scientists around the world managed to develop the vaccines speaks volumes of advances in technology and the indomitable will of humanity to put this sad chapter quickly behind them.

Lessons to be learnt

If anything, the pandemic has proven irrevocably the inseparable link between the global economy and oil. By destroying one you destroy the other and vice versa.

The global economy will continue to run on oil and gas well into the future. Oil and gas will continue to be the fulcrum of the global economy and the core business of the global oil industry throughout the 21st century and probably fa beyond.

Outlook for 2021

2021 could be the year that the global economy’s growth will accelerate and recoup most of its losses and that global oil demand will witness a speedy growth taking oil prices to $60-$70 a barrel.

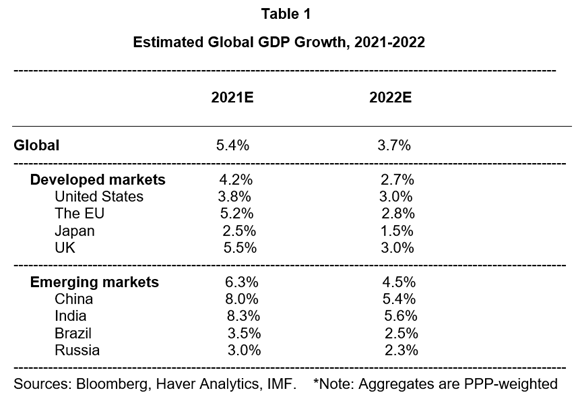

The global economy is projected to grow by an estimated 5.4% in 2021 and 3.7% in 2022 led by emerging markets particularly China and India (see Table 1).

And with a probable end to the trade war between the US and China and a possible de-escalation of tension between Iran and the United States and also in the Eastern

Mediterranean, the world and the global economy will get a breather to readjust to the post-pandemic era.

---------------------------------------------------------------------------------------------------------------

*Dr. Mamdouh G. Salameh is an international oil economist. He is one of the world’s leading experts on oil. He is also a visiting professor of energy economics at the ESCP Business School in London.

Disclaimer: "The contents of this article are the author's sole responsibility. They do not necessarily represent the views of the Hellenic Association for Energy Economics or any of its Members".